David Smith is evaluating the expected residual income as of the end of August 2013 of Silver

Question:

David Smith is evaluating the expected residual income as of the end of August 2013 of Silver Wheaton Corporation (NYSE: SLW). Established in 2004 in Vancouver, British Columbia, Silver Wheaton is the largest precious metal streaming company in the world. The company has a number of agreements whereby, in exchange for an upfront payment, it has the right to purchase all or a portion of the silver (and sometimes gold) production from mines located around the globe. Using an adjusted beta of 1.50 relative to the TSX 300 Index, a 10-year government bond yield of 2.8 percent, and an estimated equity risk premium of 4.2 percent, Smith uses the capital asset pricing model (CAPM) to estimate Silver Wheaton’s required rate of return, r, at 9.1 percent

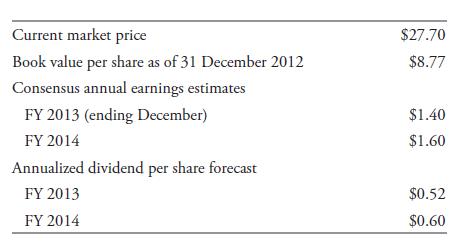

[2.8 percent + 1.50(4.2 percent)]. Smith obtains the following as of the close on 23 August 2013:

What is the forecast residual income for fiscal years ended December 2013 and December 2014?

Step by Step Answer: