Holts FCFE (in millions) for 2008 is closest to: A. $175. B. $250. C. $364. Ryan Leigh

Question:

Holt’s FCFE (in millions) for 2008 is closest to:

A. $175.

B. $250.

C. $364.

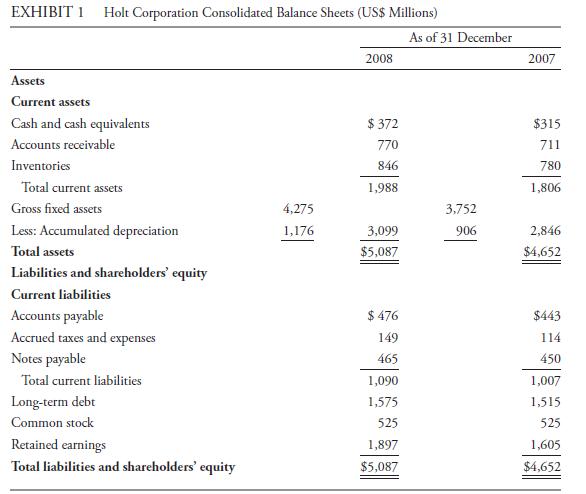

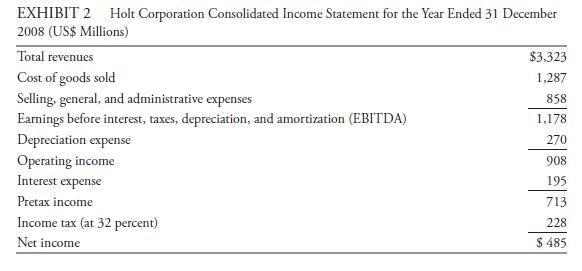

Ryan Leigh is preparing a presentation that analyzes the valuation of the common stock of two companies under consideration as additions to his firm’s recommended list: Emerald Corporation and Holt Corporation. Leigh has prepared preliminary valuations of both companies using a FCFE model and is also preparing a value estimate for Emerald using a dividend discount model. Holt’s 2007 and 2008 financial statements, contained in Exhibits 1 and 2, are prepared in accordance with US GAAP.

Leigh presents his valuations of the common stock of Emerald and Holt to his supervisor, Alice Smith. Smith has the following questions and comments:

i. “I estimate that Emerald’s long-term expected dividend payout rate is 20 percent and its return on equity is 10 percent over the long term.”

ii. “Why did you use a FCFE model to value Holt’s common stock? Can you use a DDM instead?”

iii. “How did Holt’s FCFE for 2008 compare with its FCFF for the same year? I recommend you use a FCFF model to value Holt’s common stock instead of using a FCFE model because Holt has had a history of leverage changes in the past.”

iv. “In the last three years, about 5 percent of Holt’s growth in FCFE has come from decreases in inventory.”

Leigh responds to each of Smith’s points as follows:

i. “I will use your estimates and calculate Emerald’s long-term, sustainable dividend growth rate.”

ii. “There are two reasons why I used the FCFE model to value Holt’s common stock instead of using a DDM. The first reason is that Holt’s dividends have differed significantly from its capacity to pay dividends. The second reason is that Holt is a takeover target and once the company is taken over, the new owners will have discretion over the uses of free cash flow.”

iii. “I will calculate Holt’s FCFF for 2008 and estimate the value of Holt’s common stock using a FCFF model.”

iv. “Holt is a growing company. In forecasting either Holt’s FCFE or FCFF growth rates, I will not consider decreases in inventory to be a long-term source of growth.”

Step by Step Answer: