Weeramantrys next task in researching Microsoft shares is to estimate a required return on equity (which is

Question:

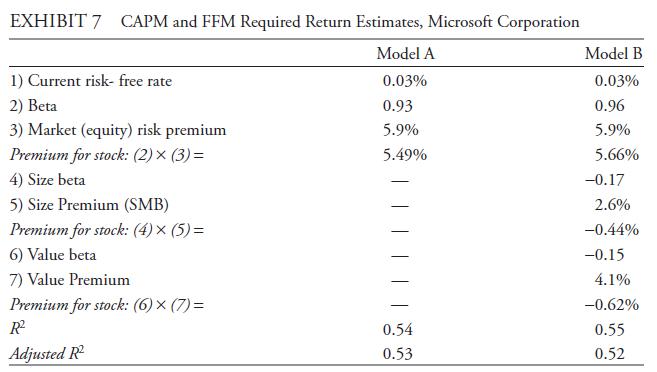

Weeramantry’s next task in researching Microsoft shares is to estimate a required return on equity (which is also a required return on total capital because Microsoft has no long-term debt). Weeramantry uses an equally weighted average of the CAPM and FFM estimates unless one method appears to be superior as judged by more than a five point difference in adjusted R2; in that case, only the estimate with superior explanatory power is used. Exhibit 7 shows the cost of equity information for Microsoft Corporation. All the beta estimates in Exhibit 7 are significant at the 5 percent level.

Weeramantry’s and Delacour’s fund holds positions for 4 years on average. Weeramantry and his colleague Delacour are apprised that their firm’s economic unit expects that the marketplace will favor growth-oriented equities over the coming year. Reviewing all the information, Delacour makes the following statements:

• “Microsoft’s cost of equity benefits from the company’s above average market capitalization.”

• “If our economic unit’s analysis is correct, growth-oriented portfolios are expected to outperform value-oriented portfolios over the next year. As a consequence, we should favor the CAPM required return estimate over the Fama–French estimate.”

Using only the above information, address the following.

i. Estimate Microsoft’s cost of equity using the:

A. CAPM.

B. Fama–French model.

ii. Judge whether Delacour’s first statement, concerning Microsoft’s cost of equity, is accurate.

iii. Judge whether Delacour’s second statement, concerning the expected relative performance of growth-oriented portfolios and the use of the CAPM and FFM required return estimates, is correct.

Step by Step Answer: