Daniel Barnes, financial manager of New York Fuels (NYF), a heating oil distributor, is concerned about the

Question:

The cost of long-term debt is 12 percent versus only 8 percent for short-term notes payable. Variable costs as a percentage of sales (74 percent) would not be affected by the firm€™s working capital policy, but fixed costs would be affected due to the storage, handling, and insurance costs associated with inventory. Here are the assumed fixed costs under the three policies:

Policy Fixed Costs

Restricted.............................. $ 950,000

Moderate............................... 1,000,000

Relaxed.................................. 1,100,000

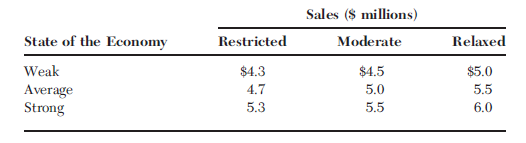

Sales also would be affected by the policy chosen: Carrying larger inventories and using easier credit terms would stimulate sales, so sales would be highest under the relaxed policy and lowest under the restricted policy. Also, these effects would vary depending on the strength of the economy. Here are the relationships Barnes assumes would have held in 2008:

Barnes considers the 2008 economy to be average. You have been asked to answer the following questions to help determine

NYF€™s optimal working capital policy:

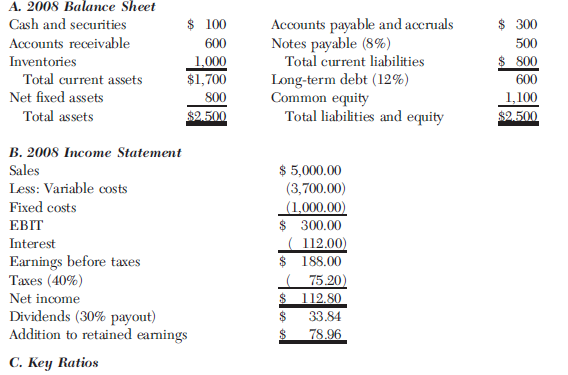

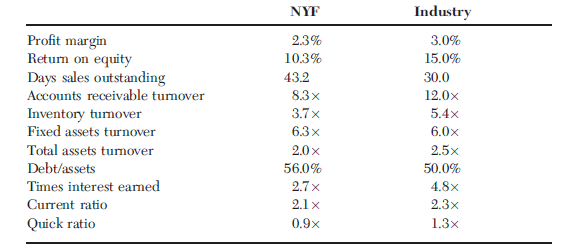

a. How does NYF€™s current working capital policy as reflected in its financial statements compare with an average firm€™s policy? Do the differences suggest that NYF€™s policy is better or worse than that of the average firm in its industry?

b. Based on the 2008 ratios and financial statements, what were the company€™s inventory conversion period, its receivables collection period, and, assuming a 29-day payables deferral period, its cash conversion cycle? How could the cash conversion cycle concept be used to help improve the firm€™s working capital management?

c. Barnes has asked you to recast the 2008 financial statements, and calculate some key ratios, assuming an average economy and a restricted (tight) working capital policy, and to check some calculations he has made. Construct these statements, and then calculate the new current ratio and return on equity (ROE). Assume that common stock is used to make the balance sheet balance, but do not get into financing feedbacks.

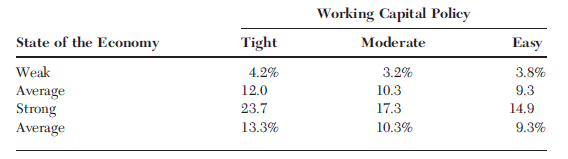

d. Barnes himself has actually analyzed the situation for each of the policies under each economic scenario; the ROEs he has calculated are shown in Table IP14-2. What are the implications of these data for the working capital policy decision?

e. The working capital policy discussion thus far has focused entirely on current assets and not at all on the current asset financing policy. How would you bring financing policy into the analysis?

Cash Conversion CycleCash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham