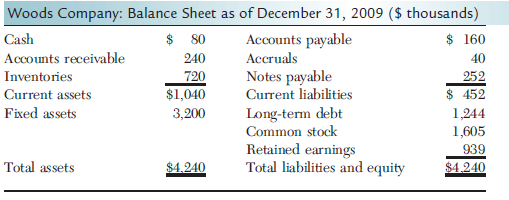

The 2009 balance sheet and income statement for the Woods Company are shown here: Woods Company: Income

Question:

Woods Company: Income Statement for the Year Ending December 31, 2009 ($ thousands)

Sales.................................................................... $ 8,000

Operating costs................................................... (7,450)

Earnings before interest and taxes.................... $ 550

Interest................................................................... ( 150)

Earnings before taxes.......................................... $ 400

Taxes (40%)............................................................ ( 160)

Net income............................................................ $ 240

Per-Share Data

Common stock price.......................................... $ 16.96

Earnings per share (EPS)...................................... $ 1.60

Dividends per share (DPS)................................... $ 1.04

a. The firm operated at full capacity in 2009. It expects sales to increase by 20 percent during 2010 and expects 2010 dividends per share to increase to $1.10. Use the projected balance sheet method to determine how much outside financing is required, developing the firm€™s pro forma balance sheet and income statement, and use AFN as the balancing item.

b. If the firm must maintain a current ratio of 2.3 and a debt ratio of 40 percent, how much financing, after the first pass, will be obtained using notes payable, long-term debt, and common stock?

c. Construct the second-pass financial statements incorporating financing feedbacks, using the ratios in part b. Assume that the interest rate on debt averages 10 percent.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham