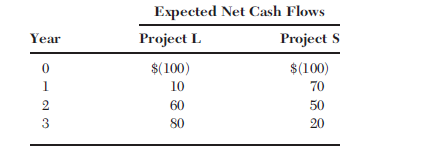

Your boss, the chief financial officer (CFO) for Southern Textiles, has just handed you the estimated cash

Question:

The CFO also made subjective risk assessments of each project, and he concluded that the projects both have risk characteristics that are similar to the firm€™s average project. Southern€™s required rate of return is 10 percent. You must now determine whether one or both of the projects should be accepted. Start by answering the following questions:

a. What is capital budgeting? Are there any similarities between a firm€™s capital budgeting decisions and an individual€™s investment decisions?

b. What is the difference between independent and mutually exclusive projects? Between projects with conventional cash flows and projects with unconventional cash flows?

c. (1) What is the payback period? Find the traditional payback periods for Project L and Project S.

(2) What is the rationale for the payback measure? According to the payback criterion, which project or projects should be accepted if the firm€™s maximum acceptable payback is two years and Project L and Project S are independent? Mutually exclusive?

(3) What is the difference between the traditional payback and the discounted payback? What is each project€™s discounted payback?

(4) What are the main disadvantages of the traditional payback? Is the payback method of any real usefulness in capital budgeting decisions?

d. (5) Define the term net present value (NPV). What is each project€™s NPV?

(6) What is the rationale behind the NPV method? According to NPV, which project or projects should be accepted if they are independent Mutually exclusive? (7) Would the NPVs change if the required rate of return changed?

e. (8) Define the term internal rate of return (IRR). What is each project€™s IRR? (9) How is the IRR on a project related to the YTM on a bond? (10) What is the logic behind the IRR method? According to IRR, which projects should be accepted if they are independent? Mutually exclusive?

(11) Would the projects€™ IRRs change if the required rate of return changed? Explain.

f. (12) Construct the NPV profiles for Project L and Project S. At what discount rate do the profiles cross?

(13) Look at the NPV profile graph without referring to the actual NPVs and IRRs. Which project or projects should be accepted if they are independent? Mutually exclusive? Explain. Do your answers differ depending on the discount rate used? Explain.

g. (14) What is the underlying cause of ranking conflicts between NPV and IRR?

(15) What is the reinvestment rate assumption, and how does it affect the NPV versus IRR conflict?

(16) Which capital budgeting method should be used when NPV and IRR give conflicting rankings? Why?

h. (17) Define the term modified internal rate of return (MIRR). What is each project€™s MIRR?

(18) What is the rationale behind the MIRR method? According to MIRR, which project or projects should be accepted if they are independent? Mutually exclusive?

(19) Would the MIRRs change if the required rate of return changed?

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Capital Budgeting

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham