Suppose the risk premiums in Example 7.8 were E(r M ) - r f = 4% and

Question:

Suppose the risk premiums in Example 7.8 were E(rM) - rf = 4% and E(rTB) - rf = 2%. What would be the equilibrium expected rate of return on Northeast Airlines?

Transcribed Image Text:

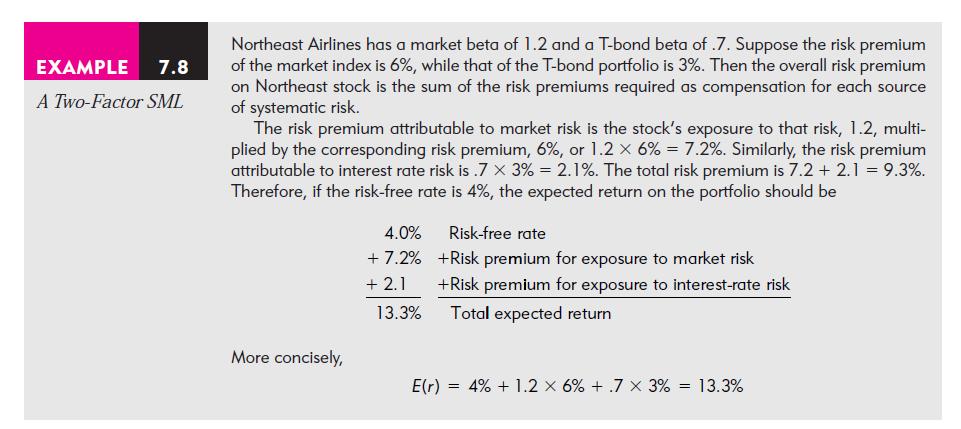

EXAMPLE 7.8 A Two-Factor SML Northeast Airlines has a market beta of 1.2 and a T-bond beta of .7. Suppose the risk premium of the market index is 6%, while that of the T-bond portfolio is 3%. Then the overall risk premium on Northeast stock is the sum of the risk premiums required as compensation for each source of systematic risk. The risk premium attributable to market risk is the stock's exposure to that risk, 1.2, multi- plied by the corresponding risk premium, 6%, or 1.2 x 6% = 7.2%. Similarly, the risk premium attributable to interest rate risk is .7 x 3% = 2.1%. The total risk premium is 7.2 + 2.1 = 9.3%. Therefore, if the risk-free rate is 4%, the expected return on the portfolio should be More concisely, 4.0% Risk-free rate +7.2% +Risk premium for exposure to market risk +2.1 +Risk premium for exposure to interest-rate risk 13.3% Total expected return E(r) = 4% + 1.2 x 6 % +.7 x 3% = 13.3%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

In the given example the equilibrium expected rate of return on Northeast Airlines Er is calculated ...View the full answer

Answered By

Antony Mutonga

I am a professional educator and writer with exceptional skills in assisting bloggers and other specializations that necessitate a fantastic writer. One of the most significant parts of being the best is that I have provided excellent service to a large number of clients. With my exceptional abilities, I have amassed a large number of references, allowing me to continue working as a respected and admired writer. As a skilled content writer, I am also a reputable IT writer with the necessary talents to turn papers into exceptional results.

4.50+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Assume that you recently graduated with a major in finance and that you just landed a job as a financial planner with Barney Smith Inc., a large financial services corporation. Your first assignment...

-

Suppose you won the Florida lottery and were offered a choice of $500,000 in cash or a gamble in which you would get $1 million if a head were flipped but $0 if a tail came up. a. What is the...

-

In the previous problem, we studied the effects of a cost-saving invention. For this problem, we suppose that there was no such invention, but that a tax is introduced. Suppose that on January 1,...

-

Data was collected for a sample of organic snacks. The amount of sugar (in mg) in each snack is summarized in the histogram below. Frequency 12 -10 8 6 4 2 n = 180 200 220 240 260 280 300 320 amount...

-

1. What is a decision support system? What advantages does a decision support system have for a business like the Harvard Cooperative Society? 2. How would the decision support system of a business...

-

Four-legged animals run with two different types of motion: trotting and galloping. An animal that is trotting has at least one foot on the ground at all times, whereas an animal that is galloping...

-

The velocity components of \(u\) and \(v\) of a two-dimensional flow are given by \[ u=a x+\frac{b x}{x^{2} y^{2}} \quad \text { and } \quad v=a y+\frac{b y}{x^{2} y^{2}} \] where \(a\) and \(b\) are...

-

Jane suffers from a degenerative spinal disorder. Her physician said that swimming could help prevent the onset of permanent paralysis and recommended the installation of a swimming pool at her...

-

Calculate the free air flow requirements for the following applications: 1. A 2 inch bore cylinder with a 10 inch stroke extends in 0.5 seconds when supplied with 83 PSIG air. The compressor intake...

-

Draw a point and figure chart using the history in Table 9.1 with price increments of $3. TABLE 9.1 Stock price history Date January 2 January 3 January 4 January 5 January 8 January 9 January 10...

-

a. What is the characteristic line of XYZ in Example 6.4? b. Does ABC or XYZ have greater systematic risk? c. What percent of the variance of XYZ is firm-specific risk? EXAMPLE 6.4 Estimating the...

-

Cobe Co. has manufactured 200 partially finished cabinets at a cost of $50,000. These can be sold as is for $60,000. Instead, the cabinets can be stained and fitted with hardware to make finished...

-

Which of the following is not a step in the accounting process? a. Identification b. Auditing c. Recording d. Communication

-

Which approach to personality emphasizes the innate goodness of people and their desire to grow? a. Humanistic b. Psychodynamic c. Learning d. Biological and evolutionary

-

__________ __________is the term Freud used to describe unconscious strategies used to reduce anxiety by distorting reality and concealing the source of the anxiety from themselves.

-

Eriksons theory of __________development involves a series of eight stages, each of which must be resolved for a person to develop optimally.

-

If the accounts of Aafaq Islamic Finance show a cash balance of $75,000, equipment $100,000, office building $500,000, and accounts payable $150,000, what is the company owners equity? a. $425,000 b....

-

Web Tools Company is considering using the proceeds from a new $50 million bond issue to call and retire its outstanding $50 million bond issue. The details of both bond issues are outlined in what...

-

Suppose Green Network Energy needs to raise money to finance its new manufacturing facility, but their CFO does not think the company is financially capable of making the periodic interest payments...

-

The stock of Nogro Corporation is currently selling for $10 per share. Earnings per share in the coming year are expected to be $2. The company has a policy of paying out 50% of its earnings each...

-

The risk-free rate of return is 8%, the expected rate of return on the market portfolio is 15%, and the stock of Xyrong Corporation has a beta coefficient of 1.2. Xyrong pays out 40% of its earnings...

-

The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next 5 years. Its latest EPS was $10, all of which was reinvested in the...

-

Journalize the adjusting entry needed at December 3 1 , 2 0 2 3 , for each situation. Consider each fact separately. ( Record debits first, then credits. Exclude explanations from any journal...

-

City Art Gallery (CAG) is an Alberta not-for-profit organization managing the operations of a gallery with 65 full-time employees and 25 volunteers. CAG is primarily funded by government grants, and...

-

at December 31 Account Name Debits Credits Cash Accounts Receivable Prepaid Rent Prepaid Insurance Supplies Trucks Accumulated Depreciation Accounts Payable Interest Payable Wages Payable Unearned...

Study smarter with the SolutionInn App