Parent Corporation purchased 75 percent of Subsidiary Corporation seven years ago. The remaining 25 percent is owned

Question:

Parent Corporation purchased 75 percent of Subsidiary Corporation seven years ago.

The remaining 25 percent is owned by Roy.

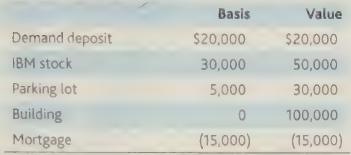

Subsidiary’s current balance sheet shows the following figures:

Subsidiary has a net operating loss carryover of $7,000 and earnings and profits of $22,000.

Subsidiary redeems Roy’s 25 percent stock interest in exchange for the IBM stock.

Subsidiary then adopts a plan of complete liquidation and distributes its assets to Parent in complete liquidation.

a. What is the tax result to Roy?

b. Does Subsidiary recognize any gain on the redemption or the liquidation?

c. What are Parent's bases for the assets received?

d. What happens to Subsidiary’s NOL and E&P?

Demand deposit IBM stock Parking lot Building Mortgage Basis $20,000 30,000 5,000 0 (15,000) Value $20,000 50,000 30,000 100,000 (15,000)

Step by Step Answer:

Answer Lets address each part of the question a Tax Result to Roy Roy exchanges his 25 percent stock ...View the full answer

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Students also viewed these Business questions

-

Parent Corporation purchased 75 percent of Subsidiary Corporation seven years ago. The remaining 25 percent is owned by Roy. Subsidiary's current balance sheet shows the following figures: Subsidiary...

-

Parent Corporation purchased 75 percent of Subsidiary Corporation in 2000; Subsidiarys current balance sheet shows the following figures: Basis Value Demand Deposit $20,000 $20,000 IBM Stock $30,000...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

A 15 mm 15 mm silicon chip is mounted such that the edges are flush in a substrate. The chip dissipates 1.4 W of power uniformly, while air at 20C (1 atm) with a velocity of 25 m/s is used to cool...

-

A waste treatment pond is 50mlong and 25mwide, and has an average depth of 2 m. The density of the waste is 75.3 lbm/ft 3 . Calculate the weight of the pond contents in lbf, using a single...

-

One card is selected at random from a deck of cards. Determine the probability that the card selected is A 5 or a 10.

-

Thrust vector control is a technique that can be used to greatly improve the maneuverability of military fighter aircraft. It consists of using a set of vanes in the exit of a jet engine to deflect...

-

Every Electronics, Inc., produces circuit boards for electronic devices that are made by more than a dozen customers. Competition among the producers of circuit boards is keen, with over 30 companies...

-

Basic Home Care sells two-year warranty plans for home repairs, paid in cash in advance. On January 2, of the current year, 160 warranty plans were sold for $700 each. What would be the adjusting...

-

Merten Corp. is 100% owned by Carmen. Merten owns one asset, a building worth $550,000 with a $90,000 basis. Carmens stock basis is $150,000. A plan of complete liquidation is adopted. What are the...

-

Pace Corp. owns 100% of the stock of Strom Corp. Paces basis for the Strom Corp. stock is $225,000. Pursuant to a plan of complete liquidation, Strom distributes to Pace assets with a fair market...

-

1. What is the climate for doing business in India? Is it supportive of foreign investment? 2. How important is a highly educated human resource pool for MNCs wanting to invest in India? Is it more...

-

3) A uniform beam of length 60 cm weighs 10 N.Its centre of gravity (the point where its weight can be assumed to act)is at its centre.A weight of 800 N rests at one end of the beam as shown, and the...

-

Consider the following Java code. private static void m(int[] a) throws ArrayIndexOutOfBoundsException { try { } for (int i = 0; i

-

Fund statements for governmental funds use the current financial resources measurement focus and the ______ basis of accounting. Multiple choice question. accrual modified accrual modified cash cash

-

A CVP graph such as the one shown below is a useful technique for showing relationships among an organization's costs, volume, and profits. 2 8 Required: 1. Identify the numbered components in the...

-

The capacity of information to make a difference in a decision is: Comparability Relevance Understandability Generally Accepted Accounting Principles (GAAP)

-

Distinguish between (a) Secured and unsecured bonds, (b) Collateral trust and debenture bonds, (c) Convertible and callable bonds, (d) Coupon and registered bonds, (e) Municipal and corporate bonds,...

-

Avatar Financials, Inc., located on Madison Avenue, New York City, is a company that provides financial advice to individuals and small- to mid-sized businesses. Its primary operations are in wealth...

-

The Grimm Corporation has two different bonds currently outstanding. Bond M has a face value of $20,000 and matures in 20 years. The bond makes no payments for the first six years, then pays $800...

-

For the company in the previous problem, suppose fixed assets are currently $895,000 and sales are projected to grow to $997,000. How much in new fixed assets is required to support this growth in...

-

You have recently won the super jackpot in the Set for Life Lottery. On reading the fine print, you discover that you have the following two options: a. You will receive 31 annual payments of...

-

A semiconductor slab waveguide is formed by a two different semiconductor layers, with the core of thickness d being GaAs and both cladding layers being AlGaAs, as shown in the figure. The index of...

-

1. A MOSFET made with n* poly-silicon gate has the following characteristics: Oxide thickness Xox = 500 = 50 nm Doping in Si: NA = 1016 cm-3 Interface oxide charges Q = 6.4 10 1.6 10-19 C/cm Area A =...

-

4. In the VLSI design, why is polysilicon, instead of metal, mainly used for gate contact for the technology with relatively small feature size (e.g. 500 nm) process? Mark where the polysilicon is...

Study smarter with the SolutionInn App