Parent Corporation purchased 75 percent of Subsidiary Corporation seven years ago. The remaining 25 percent is owned

Question:

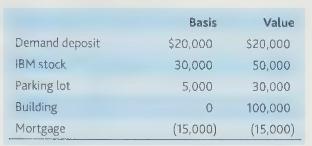

Parent Corporation purchased 75 percent of Subsidiary Corporation seven years ago. The remaining 25 percent is owned by Roy. Subsidiary's current balance sheet shows the following figures:

Subsidiary has a net operating loss carryover of \(\$ 7,000\) and earnings and profits of \(\$ 22,000\).

Subsidiary redeems Roy's 25 percent stock interest in exchange for the IBM stock.

Subsidiary then adopts a plan of complete liquidation and distributes its assets to Parent in complete liquidation.

a. What is the tax result to Roy?

b. Does Subsidiary recognize any gain on the redemption or the liquidation?

c. What are Parent's bases for the assets received?

d. What happens to Subsidiary's NOL and E\&P?

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback