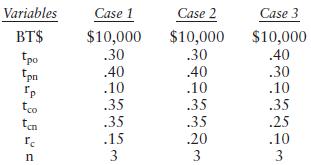

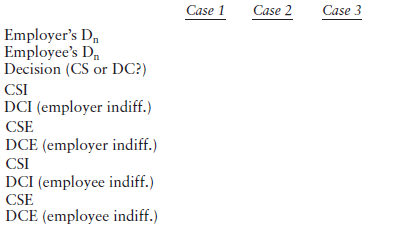

Consider the following facts: a. Complete the following table for each case: b. Suppose in Case 2

Question:

a. Complete the following table for each case:

b. Suppose in Case 2 from Part a that the employer and employee negotiate a Dn of 1.62. Compute CSI, DCI, CSE, and DCE with this Dn to show that each party to the deferred compensation contract shares in the tax benefit.

Transcribed Image Text:

Case 3 Case 2 Variables Case 1 $10,000 BT$ $10,000 $10,000 .30 .30 .40 tpo tpn .40 .10 .40 .30 .10 .10 .35 .35 .35 .35 tco .35 .25 .15 .20 .10 3 3. Case 1 Case 2 Case 3 Employer's D, Employee's D, Decision (CS or DC?) CSI DCI (employer indiff.) CSE DCE (employer indiff.) CSI DCI (employee indiff.) CSE DCE (employee indiff.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

a The following table summarizes the results for Cases 1 3 In Case 1 the parties prefer current sala...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Consider the following facts: a. Beginning and ending Accounts Receivable are $ 20,000 and $ 24,000, respectively. Credit sales for the period total $ 62,000. b. Cost of goods sold is $ 76,000. c....

-

Consider the following facts for Vanilla Valley: a. Beginning and ending Retained Earnings are $43,000 and $69,000, respectively. Net income for the period is $58,000. b. Beginning and ending Plant...

-

Consider the following facts for Espresso Place: a. Beginning and ending Retained Earnings are $ 44,000 and $ 70,000, respectively. Net income for the period is $ 61,000. b. Beginning and ending...

-

} S 1995 the # of Farms Century, data year 1935 1990 19.50 Aumcon people living on declined steadily during the shown by the Follow g as (in milion of persons) from 1935 19.55 1960 1965 11975 1980...

-

1. Are the majority of the HR activities performed today by organizations more focused on operational activities or strategic activities.....and why do you say this? 2. Which part of the organization...

-

Show how social media communications can support the areas of the PRACE framework as part of a social media communications plan.

-

Amy commutes to work by two different routes A and B. If she comes home by route A, then she will be home no later than 6 P.M. with probability 0.8, but if she comes home by route B, then she will be...

-

Casey Carpet manufactures broadloom carpet in seven processes: spinning, dyeing, plying, spooling, tufting, latexing, and shearing. In the Dyeing Department, direct materials (dye) are added at the...

-

Asset allocation is a strategy that helps you choose how much money to put in stocks, bonds and cash when you invest for retirement. Simply put, asset allocation is nothing more than striking a...

-

The luminosity of the star Aldebaran is 520 times that of the Sun. The wavelength of light at peak intensity for Aldebaran is 740 nm and the wavelength of light at peak intensity for the Sun is 500...

-

Consider Marsha and Todd from Example I:18-28 in the text. Suppose these employees worked for Learned University, a tax-exempt organization, instead of a taxable corporation. The universitys BTROR...

-

Sandy will earn a $100,000 bonus that can be split between current and deferred compensation in any of the following ways: Current (BT$)* Deferred (BT$)*...

-

What is the value of Michaels capital at the end of 2015? Michael is an Internet service provider. On December 31, 2014, he bought an existing business with servers and a building worth $400,000....

-

Provide some recommendations for the improvement of SRC Scientific research Council in Jamacia They are apart of the agricultural ministry ?

-

ThinkBox has the following financial results for the month of June: Sales $3,120,000 Variable costs 1,920,000 CM 1,200,000 Fixed costs 1,380,000 Profit(loss) $(180,000) A total of 200,000 units were...

-

Precision Tool is trying to decide whether to lease or buy some new equipment for its tool and die operations. The equipment costs $50,000, has a 3-year life and will be worthless after the 3 years....

-

Water Corporation distributes property valued at $315,000 and with a basis of $220,000 to a shareholder in a qualifying stock redemption. The property is subject to a liability of $160,000 that the...

-

With the following information calculate the cash conversion cycle the gross profit margin of the company is 30% Sales $ 350,000.00 Cash Balance $ 55,000.00 Accounts Receivables $ 65,000.00 Accounts...

-

Fill in the blank(s) to correctly complete each sentence. The graph of the line y - 3 = 4(x - 8) has slope__________and passes through the point (8, ________).

-

Clark, PA, has been engaged to perform the audit of Kent Ltd.s financial statements for the current year. Clark is about to commence auditing Kents employee pension expense. Her preliminary enquiries...

-

The City of Omaha donates land worth $500,000 to Ace Corporation to induce it to locate in Omaha and create an estimated 2,000 jobs for its citizens. a. How much income, if any, must Ace report on...

-

Kobe transfers $500,000 in cash to newly formed Bryant Corporation for 100% of Bryants stock. In the first year of operations, Bryants taxable income before any payments to Kobe is $120,000. What...

-

Tom and Vicki are married and file a joint income tax return. They each purchase 50% of the stock in Guest Corporation from Al for $75,000. Tom is employed full-time by Guest and earns $100,000 in...

-

Start Access. Open the downloaded Access file named Exp19_Access_Ch03_ML1_Small_Business_Loans.accdb . Grader has automatically added your last name to the beginning of the filename. Note this file...

-

Commercial law in Canada list the questions should ask for this case: EMPLOYMENT Holm V. Agat Laboratories Ltd Bailey Gakhal, Brandon Longstreet, Colton Yaremko, Levi Johnson, & Nyah Foote October...

-

What are the underlying molecular processes that govern the remarkable adaptability of prokaryotes to extreme environments, such as those characterized by high temperatures, acidity, or salinity?

Study smarter with the SolutionInn App