Sandy will earn a $100,000 bonus that can be split between current and deferred compensation in any

Question:

Current (BT$)* Deferred (BT$)*

$100,000...................................................$ €“0€“

80,000.....................................................20,000

60,000.....................................................40,000

40,000.....................................................60,000

20,000.....................................................80,000

€“0€“.........................................................100,000

* The numbers in the above lists are BT$ as in the text formulas. Thus, the numbers in the second column are not BT$ × Dn.

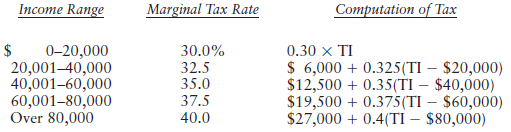

Assume that Sandy is subject to the following progressive tax rate schedule in the current and future years:

€¢ Corporate tax rates are as follows: tco = .35, tcn = .34.

€¢ Rates of return are as follows: rc = .08; rp = .07.

€¢ The length of deferral is five years, i.e., n = 5.

a. What is the best way for Sandy to split the $100,000 bonus given a level of Dn that makes the corporation indifferent?

b. Now assume the bonus allocations are not restricted to $20,000 increments. What is the optimal allocation of the current and deferred bonus given the level of Dn that makes the employer indifferent?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: