(a) Make a chart similar to Fig. 6.9 showing the price of a put option using the...

Question:

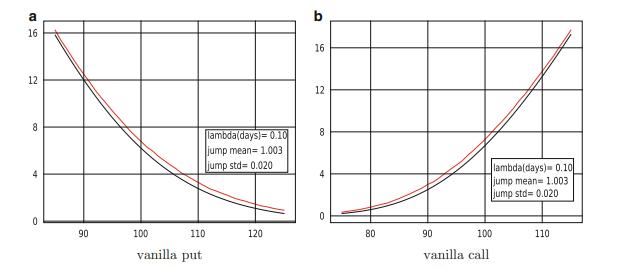

(a) Make a chart similar to Fig. 6.9 showing the price of a put option using the jump diffusion model with lognormal jumps for stock prices versus the GBM model. In order to compare the results with jump diffusion using N(μJ , σ2 J) jumps, find α and β to match the mean and variance,

![]()

(b) Do the same for calls.

Data Given in Figure 6.9

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: