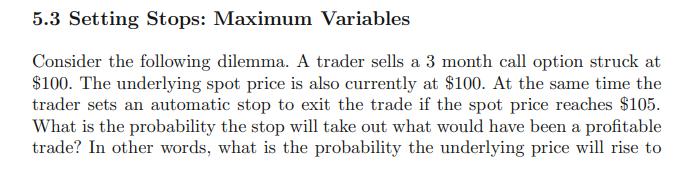

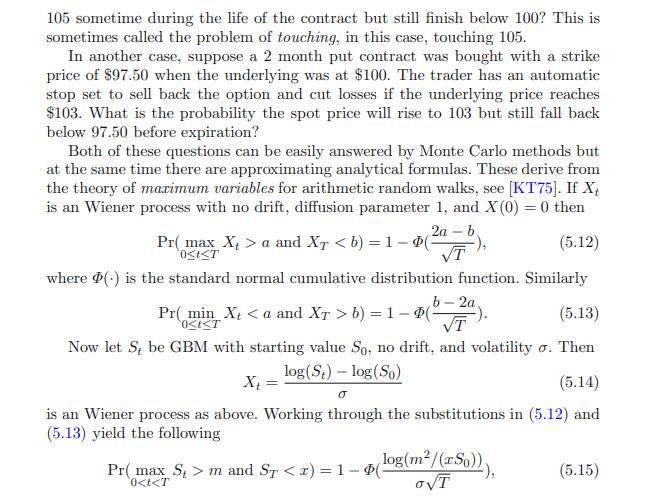

Answer the second dilemma in the section on maximum variables, Section 5.3. If the volatility is 20

Question:

Answer the second “dilemma” in the section on maximum variables, Section 5.3. If the volatility is 20 % and the time to expiration is 2 months, what is the probability that the stock price starting from 100 will rise above 103 over the term of theput option but nevertheless finish below 97.50? In the first case, assume the drift is zero. Write a program to answer the question if the drift is 6 %, if the drift is −4 %.

Data given in Section 5.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: