Joyce Cathey owns Southwest Golf Shop. She has reviewed the following preliminary financial data prepared for the

Question:

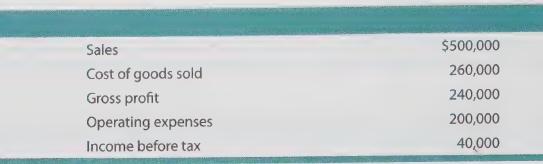

Joyce Cathey owns Southwest Golf Shop. She has reviewed the following preliminary financial data prepared for the year ending December 31, 20X8:

Joyce has determined that the above data were based on assumptions that beginning-of year inventory was \($230\),000 and end-of-year inventory was \($265\),000. The company uses a periodic inventory system.

Joyce has owned the golf shop for many years and is surprised and disappointed with these financial results. Accordingly, she has conducted an extensive review of the accounting for selected transactions. Her reviewed turned up the following errors:

A spreadsheet of beginning inventory included 35 Zing golf bags at a cost of \($20\) each.

These particular bags were the nicest in the store, and the unit cost was actually \($200\). The error was the result of incorrect data entry into the spreadsheet.

The ending inventory value was the result of a physical count on December 31, 20X8.

The count failed to include 2,400 imprinted logo golf balls that were in the custody of employees who were going to be giving them away as promotional items at a New Year's day parade on January 1, 20X9. These balls cost \($1.50\) each.

The company experienced a theft loss during 20X8. The theft consisted of 6 sets of Caldaway golf clubs that normally sell for \($1\),000 each, and provide a gross profit margin of 45%. The insurance company purchased replacement goods and delivered them to Southwest Golf Shop. These club sets were included in the year end physical inventory and valued at \($1\),000 each.

In 20X8, the company consigned golf apparel with a retail value of \($30\),000 to a vendor at a local golf tournament. The cost to retail percentage on apparel is 60%. At the conclusion of the tournament, the vendor returned \($12\),000 (at retail) of goods and \($18\),000 in cash.

The agreement was that Southwest Golf Shop would pay the vendor a commission equal to 15% of the gross profit margin on sales. The commission has not yet been calculated or paid.

At year end, the company had 10 units of the Big Face driver in stock. The drivers had a unit cost of \($300\), and were included in the year end inventory at \($3\),000 total. The manufacturer of Big Face has just announced a new driver, the Square Face. These units will render the Big Face mostly obsolete. Even thought the manufacturer will continue to offer Big Face for sale at a dealer cost of \($300\), it is anticipated the customers will now be willing to pay no more than \($200\) retail for the item.

Determine the correct income statement and inventory values. Will Joyce be pleased with the revised results?

Step by Step Answer: