Several potential investors have been studying the affairs of Pelican Corporation to decide whether to invest in

Question:

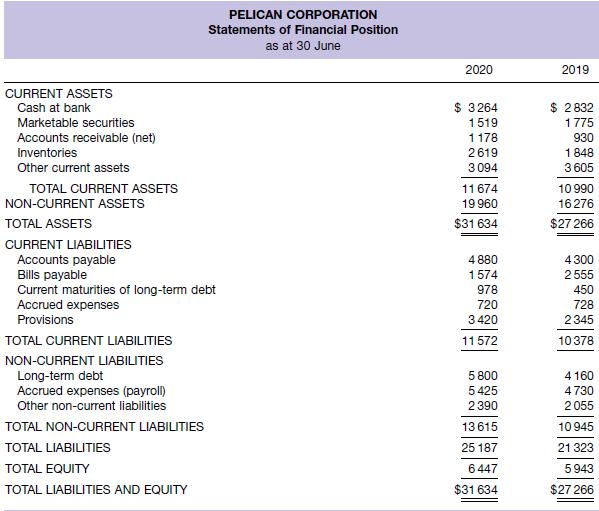

Several potential investors have been studying the affairs of Pelican Corporation to decide whether to invest in the company by purchasing unsecured notes which the company was proposing to issue. There was some speculation that the company was experiencing liquidity problems. The statements of financial position at 30 June 2019 and 2020 follow:

Required

(a) Calculate appropriate liquidity and financial stability ratios for the years ended 30 June 2019 and 2020. Research reveals that typical ratios in the industry for the current and quick ratios are 1.7:1 and 1.0:1 respectively. For financial stability ratios, industry averages are 2.5:1 for the capitalisation ratio and 60% for the debt ratio.

(b) Comment on the liquidity and financial stability of the company, given the information available.

(c) Would you, as one of the potential purchasers of the unsecured notes, lend money to the company? Explain why or why not.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield