A Wall Street Journal article dated October 31, 2007, reported that an internal investigation at Dell Inc.

Question:

A Wall Street Journal article dated October 31, 2007, reported that an internal investigation at Dell Inc. had uncovered evidence of earnings management. The article states: An internal investigation found that senior executives and other employees manipulated the company's financial statements to give the appearance of hitting quarterly performance goals. One of the biggest problems uncovered in the investigation was the way Dell recognized revenue on software products it sells. Dell, a large reseller of other companies' software products, said it historically recognized revenue from software licenses at the time that the products were sold. Based on its internal review, it should have deferred more revenue from software sales.

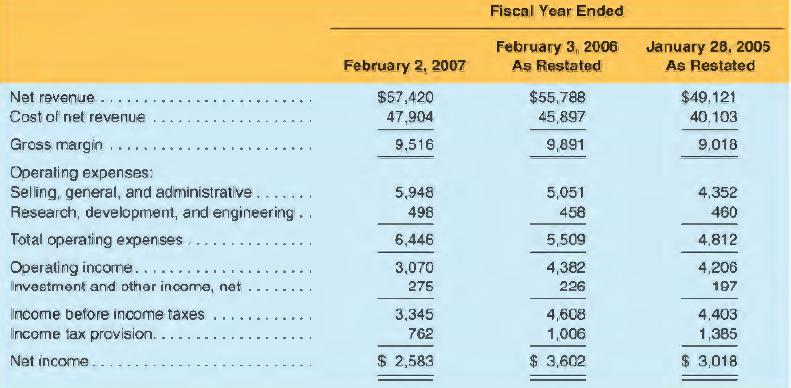

Another issue was product warranties. In some cases, Dell said it improperly recognized revenue associated with [extended] warranties over a shorter period of time than the duration of the contract. The income statements from Dell's 2007 I0-K report are presented below, along with the footnote outlining D ell's revenue recognition policies:

Revenue Recognition Net revenue includes sales of hardware, software and peripherals, and services (including extended service contracts and professional services). These products and services are sold either separately or as part of a multiple-element arrangement. Dell allocates revenue from multiple-element arrangements to the elements based on the relative fair value of each element, which is generally based on the relative sales price of each element when sold separately. The allocation of fair value for a multiple-element arrangement involving software is based on vendor specific objective evidence ("VSOE"), or in the absence of VSOE for delivered elements, the residual method. Under the residual method, Dell allocates revenue to software licenses at the inception of the license term when VSOE for all undelivered elements, such as Post Contract Customer Support ("PCS"), exists and all other revenue recognition criteria have been satisfied. In the absence of VSOE for undelivered elements, revenue is deferred and subsequently recognized over the term of the arrangement. For sales of extended warranties with a separate contract price, Dell defers revenue equal to the separately stated price. Revenue associated with undelivered elements is deferred and recorded when delivery occurs. Product revenue is recognized, net of an allowance for estimated returns, when both title and risk of loss transfer to the customer, provided that no significant obligations remain. Revenue from extended warranty and service contracts, for which Dell is obligated to perform, is recorded as deferred revenue and subsequently recognized over the term of the contract or when the service is completed. Revenue from sales of third-party extended warranty and service contracts or software PCS, for which Dell is not obligated to perform, and for which Dell does not meet the criteria for gross revenue recognition under EITF 99-19 is recognized on a net basis. All other revenue is recognized on a gross basis.

REQUIRED

a. Explain how Dell accounts for sales of other companies' software products. What are the potential risks of abuse of these accounting policies as a means to manage earnings?

b. Explain how Dell accounts for sales of extended warranty contracts. How did Dell employees manipulate these policies to manage earnings?

c. Discuss the incentives that exist to manage earnings to "give the appearance of hitting quarterly performance goals." How can a company such as Dell prevent earnings management in circumstances such as this?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman