John Wiley and Sons, Inc. publishes books, periodicals, software, and other digital content. Its April 30, 2018,

Question:

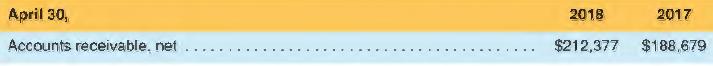

John Wiley and Sons, Inc. publishes books, periodicals, software, and other digital content. Its April 30, 2018, balance sheet reported the following amounts for accounts receivable($ thousands):

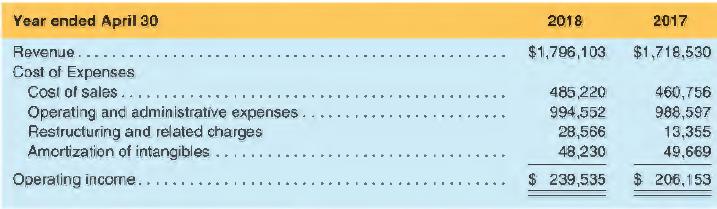

Wiley's income statement provided the following detail of operating income($ thousands):

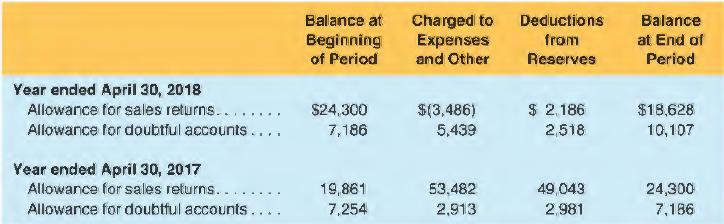

Wiley normally charges operating and administrative expenses for estimated doubtful accounts. The company provided the following supplemental information concerning doubtful accounts and returns in its footnotes ($ thousands):

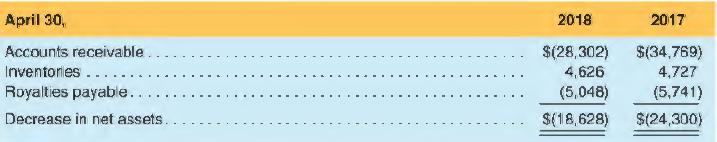

Net sales return reserves are reflected in the following accounts of the Consolidated Statements of Financial Position- increase (decrease):

REQUIRED:

a. Prepare journal entries to record bad debts expense and accounts receivable write-offs for 2017 and 2018. Post to the Allowance for doubtful accounts T-account.

b. Compute the allowance for doubtful accounts as a percentage of accounts receivable. What might account for the change from 2017 to 2018?

c. Wiley has also established an allowance for returns. How do returns differ from doubtful accounts? Under what circumstances might this difference affect the accounting for returns?

d. Calculate the accounts receivable turnover ratio and average collection period for 2018 using net accounts receivable.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman