During 2017, Amazon.com, Inc., made two significant acquisitions intending to expand the company's retail presence. On May

Question:

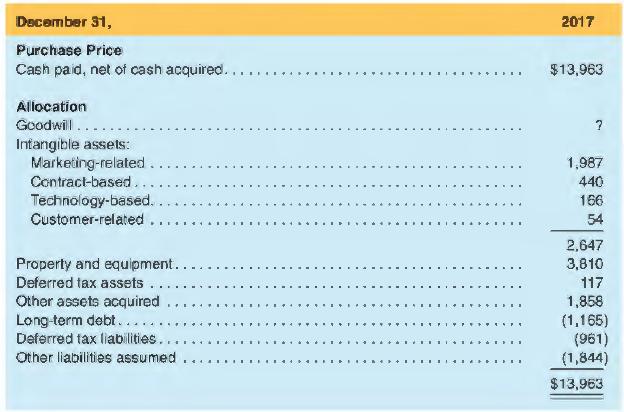

During 2017, Amazon.com, Inc., made two significant acquisitions intending to expand the company's retail presence. On May 12, 2017, Amazon acquired Souq Group Ltd. ("Souq"), an e-commerce company, for approximately $583 million, net of cash acquired and on August 28, 2017, acquired Whole Foods Market, a grocery store chain, for approximately $13.2 billion, net of cash acquired. Other acquisitions were also made for consideration of $204 million making a total of $13,963 million (net of cash acquired) for the year. From the footnote of its 2018 10-K, Amazon provides the following information:

The aggregate purchase price of these acquisitions was allocated as follows (in millions):

a. How are the values in the above table determined?

b. How much goodwill would Amazon.com recognize from these acquisitions? How will that goodwill be treated in subsequent periods?

c. Do you think Amazon.com shareholders would prefer to see an allocation that gives a lot of value to separately-identifiable assets or an allocation where most of the acquisition price goes to goodwill? Why?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman