On January 1 of the current year, Healy Company purchased all of the common shares of Miller

Question:

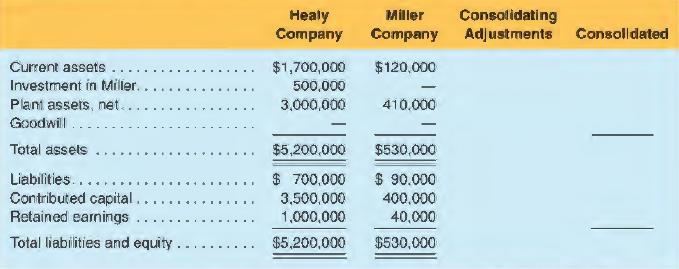

On January 1 of the current year, Healy Company purchased all of the common shares of Miller Company for $500,000 cash. Balance sheets of the two firms at acquisition follow.

During purchase negotiations, Miller's plant assets were appraised at $425,000; and all of its remaining assets and liabilities were appraised at values approximating their book values. Healy also concluded that an additional $45,000 (in goodwill) demanded by Miller's shareholders was warranted because Miller's earning power was better than the industry average.

(1) Prepare the consolidating adjustments

(2) Prepare the consolidated balance sheet at acquisition

(3) Prepare journal entries to record the transactions

(4) Post the journal entries to their respective T-accounts

(5) Record each of the transactions in the financial statement effects template.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman