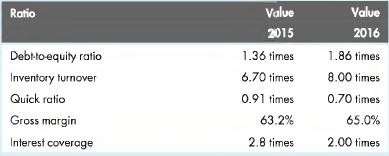

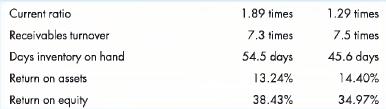

The following ratios describe the performance of Ratio Ltd for 2015 and 2016: 1. Classify these ratios

Question:

The following ratios describe the performance of Ratio Ltd for 2015 and 2016:

1. Classify these ratios into those relating to:

a. Profitability

b. Liquidity and solvency

c. Financing

d. Activity.

2. Based on the ratio values supplied, comment on the company's performance in 2016 in each of the following categories:

a. Profitability

b. Liquidity and solvency

c. Financing

d. Activity.

In addition, note the limitations of conclusions drawn from the provided information, and indicate what other information would be helpful in assessing the company's performance.

3. Explain the following:

a. Why do the return on assets and return on equity ratios differ?

b. Why would the return on assets ratio be calculated if you had already calculated the return on equity ratio? (You may find it helpful to consider how these ratios are calculated.)

4. Consider the inventory turnover ratio and the days inventory on hand ratio:

a. What information do these ratios provide?

b. From the viewpoint of management, what are the limitations relating to these ratios?

5. During 2016, the chief financial officer (CFO) of Ratio Ltd employed an independent valuer to assess the current value of the land and buildings owned by the company. The valuer had advised the CFO that the value of the land and buildings had increased by $50 000 (10 percent). Assume that this increased value is reflected in the ratios provided in the first half of this chapter. Explain how this accounting policy choice would have affected each of the ratios.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson