A trader registered for VAT but dealing in products zero rated for VAT acquired a vehicle, computers

Question:

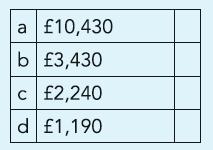

A trader registered for VAT but dealing in products zero rated for VAT acquired a vehicle, computers for office use and furniture for £47,000, £7,990 and £15,040 respectively. These prices are all inclusive of VAT at 17.5%. How much VAT refund can he expect to receive in respect of these transactions?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: