Afford Mills is in business as a wholesale dealer in textiles. Sales in the year ended 30

Question:

Afford Mills is in business as a wholesale dealer in textiles. Sales in the year ended 30 June 2010 were £365,000 and Afford allows its customers 45 days’ credit, with sales taking place consistently throughout the year.

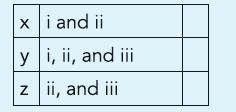

(a) If, following 25% increase in sales in the year ended 30 June 2011, there is an increase in the amount of trade receivables, the increase in receivables will need to be funded by:

(i) Obtaining more credit from suppliers

(ii) Retaining more profit within the business

(iii) Introducing additional capital

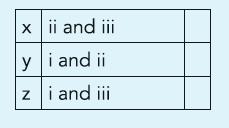

(b) It is not sensible for Afford Mills to reduce the credit period allowed to its customers to less than 45 days when:

(i) Competitors allow 45 days

(ii) Business is short of cash

(iii) Afford is attempting to increase its sales

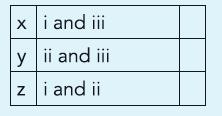

(c) It is not sensible for Afford Mills to extend the credit period allowed to customers to more than 45 days when:

(i) The business has cash flow problems

(ii) The business is unable to meet the customers’ demand for more goods

(iii) The customers are not buying as much as they did earlier

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict