Information stated below is in respect of a business which commenced several years ago. Office equipment and

Question:

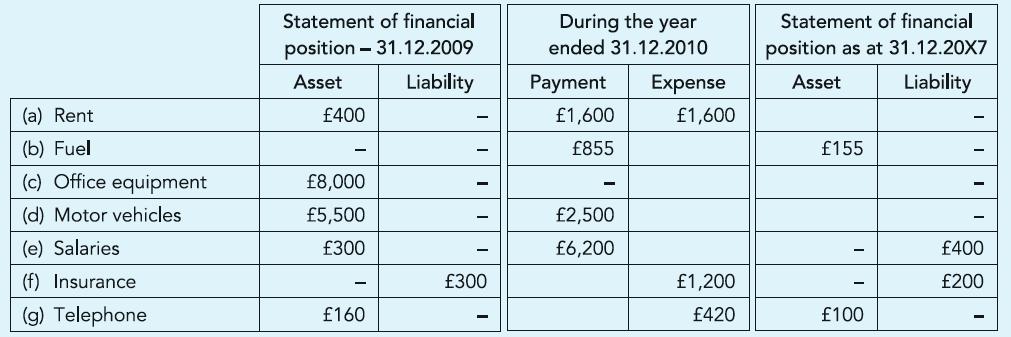

Information stated below is in respect of a business which commenced several years ago.

Office equipment and motor vehicles are depreciated at 20% and 25% per annum respectively, using the straight-line method. New vehicles were paid for on 1.1.2010.

Required:

Fill in the blanks with appropriate figures.

Transcribed Image Text:

(a) Rent (b) Fuel (c) Office equipment (d) Motor vehicles. (e) Salaries (f) Insurance (g) Telephone Statement of financial position - 31.12.2009 Asset Liability £400 £8,000 £5,500 £300 £160 - £300 During the year ended 31.12.2010 Payment £1,600 £855 £2,500 £6,200 Expense £1,600 £1,200 £420 Statement of financial position as at 31.12.20X7 Asset Liability £155 £100 - - - £400 £200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

a Rent b Fuel c Equipment d Motor veh...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

The following figures have been extracted from the accounting records of Lavalamp on 30 September 20X3: (i) Lavalamp has spent $6 million (included in the cost of sales) during the year developing...

-

Assume that you are the owner of a wholesale store and that you operate as a sole trader. On April 1, 2019 you had the following items in your business: Stock, $14,500,000; Motor vehicles,...

-

The trial balance for LPO at 31 December 2013 was as follows: Notes: (i) Closing inventory at 31 December 2013 was $562,000. (ii) On 31 December 2013, LPO disposed of some obsolete plant and...

-

In this study researchers found a correlation between the cleanliness of the homes children are raised in and the years of schooling completed and earning potential for those children What...

-

What is of the following components of a CEO contract is defined as the payment the company will make to the CEO in the event that the ownership of the company changes? A. Say-on-pay B. Vested stock...

-

St. Louis County is 24% African American. Suppose you are looking at jury pools, each with 200 members, in St. Louis County. The null hypothesis is that the probability of an African American being...

-

Imagine that you take a metal spring, compress it to its most compact length, and tie some string around it to keep it compressed. There is now potential energy stored in the compressed spring. You...

-

In 2009, Xio and Xandra each invest $300,000 to create Xava Corporation. Xava develops and manufactures rock climbing and bungee jumping equipment. The business has become very profitable (it now is...

-

18.A sine wave is travelling in a medium. The minimum distance between the two particles, always having same speed, is (1) (2)

-

Staff salary remaining unpaid as at the year-end should be accounted for as: (a) Debit Staff salary account and credit Cash account (b) Debit Staff salary account and credit Salary accrued account...

-

The year-end Trial Balance of a business owned by Frances Inglish is shown. You have been provided with following information: (a) On the basis of an inventory count conducted on 7 July 2010, the...

-

Sir Alex Ferguson has been teaching at Harvard Business School. His leadership technique has been described as largely based on the application of fear (White, 2012). He is well known for his...

-

1.The Fleming Company, a food distributor, is considering replacing a filling line at its Oklahoma City warehouse. The existing line was purchased several years ago for $650,000. The line's book...

-

As shown in the FINA 340 course website, you are asked to adjust your bank's balance sheet to include different sources of funding and investment. In Round 4, you have expanded opportunities to lend...

-

Analyze projected costs, revenue streams, and net present value for a financial counselor from launch until two years after the breakeven point. Include the following as part of the analysis: Budget...

-

X Company acquired 80% of the stock of Y Company and is preparing consolidated financial statements. It has measured the noncontrolling interest representing the 20% of Y that X does not own. How is...

-

State FOUR factors that could influence the price of land as a factor of production.

-

The following data represent the average number of hours per week that a random sample of 40 college students spend online. The data are based on the ECAR Study of Undergraduate Students and...

-

Audrey purchases a riding lawnmower using a 2-year, no-interest deferred payment plan at Lawn Depot for x dollars. There was a down payment of d dollars and a monthly payment of m dollars. Express...

-

Exhibits 12.20 and 12.21 present selected information from the notes to the financial statements of Treadaway, Inc., a tire manufacturing company, regarding its U.S. pension and health care...

-

Exhibit 12.22 presents selected information from the notes to the financial statements of Catiman Limited, a manufacturer of farming equipment, for the years ending October 31, 2013, 2012, and 2011....

-

Exhibit 12.23 presents information from the income tax note to the financial statements for E-Drive, a European computer manufacturer, for the years ending December 31, 2013, 2012, and 2011. E-Drive...

-

Consider the quadratic polynomial f(x) = ax2, with free parameter a > 0. Clearly, this quadratic has a global minimum at x = = 0. a. Set a = 1. Perform three iterations of gradient descent by hand...

-

5. (25 points total) Let R(A, B, C, D) satisfy the FDs AD, ABC, C D. (a) (5 points) List all the keys for R. (b) (10 points) List all BCNF violations. Give each violation in the form, S+ = T, where S...

-

A structural square post (16 cm x 16 cm) supports a compressive load of 245,000 N. Determine the factor of safety if the post is made of Southern pine with a compressive yield strength of 40 MPa.

Study smarter with the SolutionInn App