Jessica Parker is a graduate in management and finance, and is reporting in a current account maintained

Question:

Jessica Parker is a graduate in management and finance, and is reporting in a current account maintained in the ledger the amounts she may feel free to withdraw at any time from the business. She has extracted the year-end Trial Balance from the books of her business as shown on the right and informs you as follows:

(a) Jessica has been depreciating the buildings on the straight-line method, assuming that a third of the cost relates to land which is not depreciated and assuming the useful life of the buildings to be 50 years. Professional valuers have valued the land and the buildings as at 1 October 2010 as £1 million and £1.6 million respectively. Jessica wishes to incorporate these values into her books but wishes that only amounts legally distributable should be included in her current account.

(b) The only movements in non-current assets were:

(i) A new vehicle was acquired for £80,000 on 1 January 2011; and

(ii) a machine acquired for £120,000 on 1 June 2009 was sold on 31 May 2011 for £85,000. The only accounting entries made for recording the disposal were posting the amount received to the Sales account.

(c) Rent for several shop premises in main city centres has been agreed at £10,000 per month.

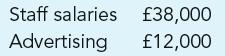

(d) Following expenses remain unpaid at year-end:

(e) Machinery is depreciated at 5% per annum using the straight-line method; while vehicles are depreciated at 40% per annum on the reducing balance method.

(f) 60% of owned land and building are used for production activity.

(g) The cost of goods remaining unsold on 30 September 2011 has been identified as £578,000. However, this includes at £42,000 certain goods which, being shop-soiled because they were used for display, may be sold for only £25,000, provided an additional cost of £2,000 is incurred on restoring them to saleable condition. Jessica regards the loss as part of her sales promotion expenses.

(h) £6,000 of trade receivables should be written off and the allowance for doubtful debts adjusted to cover 5% of remaining receivables.

Required:

Prepare the Statement of income for the year ended 30 September 2011 and the Statement of financial position as at that date. You must identify carefully any amount Jessica may feel free to withdraw from the business.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict