Machinery acquired for 720,000 was reported at 494,000 on the Statement of financial position as at 30

Question:

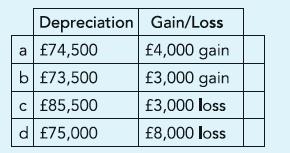

Machinery acquired for £720,000 was reported at £494,000 on the Statement of financial position as at 30 June 2010. A machine was acquired for £60,000 on 1 December 2010 and another acquired for £120,000 on 1 June 2005 was sold for £52,000 on 30 April 2011. Depreciation is calculated at 10% of cost per annum with time apportionment. Calculate the depreciation in the year ended 30 June 2011 and the gain or loss on disposal of machinery.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: