Hero Moto Corp Ltd. (Formerly Hero Honda Motors Ltd.) is the worlds largest manufacturer of two-wheelers, based

Question:

Hero Moto Corp Ltd. (Formerly Hero Honda Motors Ltd.) is the world’s largest manufacturer of two-wheelers, based in India. In 2001, the company had achieved the coveted position of being the largest two-wheeler manufacturing company in India and also the ‘World No.1’ two-wheeler company in terms of unit volume sales in a calendar year. Hero Moto Corp Ltd. continues to maintain this position till date. It derives its income from manufacturing and sale of motorcycles.

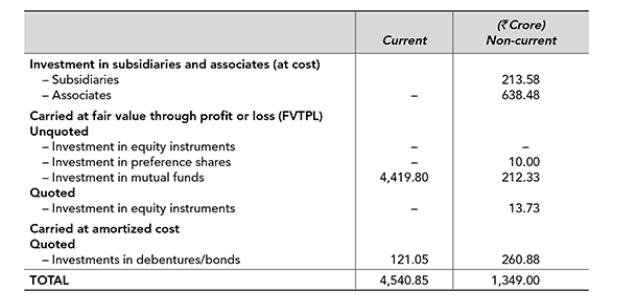

The company invests its surplus cash primarily in mutual funds and bonds & debentures. The company has invested in subsidiaries and associate companies for business purposes. As on 31st March 2017, the carrying amounts of current and noncurrent investments was reported at 4,540.85 crore and 1,349.00 crore, respectively. The breakup of these investments is given below:

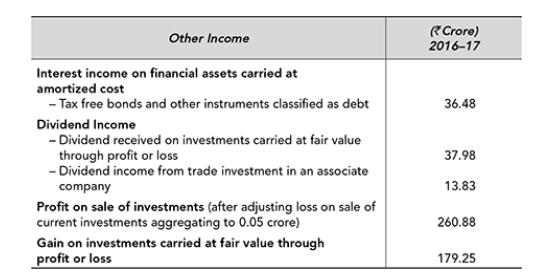

During the year 2016–17, the other income relating to investments, recognized by the company in the statement of profit and loss, included:

Questions for Discussion

1. How are current investments different from noncurrent investments?

2. Hero Motocorp Limited has classified its investments in bonds and debentures as ‘measured at amortized cost’, whereas investment in mutual funds is classified as ‘measured at fair value through profit or loss’. What are the conditions to be met for such classification?

3. Why is the investment in subsidiaries and associates carried at cost? How would you treat impairment in their value, if any?

4. The company has carried its equity investment at fair value through profit or loss. Is it possible to classify equity investments as FVTOCI?

5. Is it possible for the company to reclassify its investment in bonds/debentures to FVTPL? If yes, how would it impact the financial statements of the company?

Step by Step Answer: