The Bombay Dyeing and Manufacturing Company Limited was established in the year 1879. It is a leading

Question:

The Bombay Dyeing and Manufacturing Company Limited was established in the year 1879. It is a leading player offering products like stylish linens, towels, home furnishings, leisure clothing and kids wear, etc. As per the accounting policy of the company, the inventories are valued at lower of cost and net realizable value.

During the month of March 2003, the company entered into a firm purchase contract for import of raw material viz. paraxylene at an aggregate cost of ₹ 27.82 crore. Paraxylene is an important input for manufacturing dimethyl terephthalate (DMT), one of the main products of the company. The company ‘expected that the net realizable value, estimated at ₹ 14.96 crore, will be substantially lower than the cost, compared with reference to the estimated selling price of DMT’ . Accordingly a provision for this loss, estimated at ₹ 12.86 crore was made in the accounts for the year 2002–03.

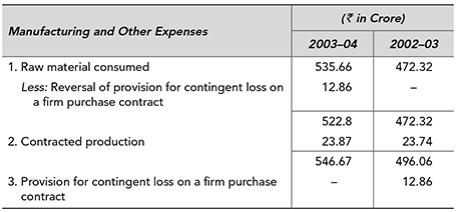

However, the company decided to reverse this provision during the year 2003–04. Accordingly, the provision for the loss was reversed during the year 2003–04 by adjusting the same from the cost of raw material consumed. The cost of inventory consumed as shown in the schedule to accounts is shown below:

The profit before tax for the company for the year 2002–03 and 2003–04 stood at ₹ 33.53 crore and ₹ 72.56 crore respectively.

Questions for Discussion

1. How to ascertain the realizable value of the raw material? Should the company have considered the replacement cost of the raw material?

2. What is the impact of above provisioning and reversal on the profit of the company? What would have been the profit before tax for the two years in question if no provisioning was done for the contingent loss?

3. What is the impact of the above transaction on the balance sheet of the company for the two years in question?

Step by Step Answer: