What is EVA? Traditional approaches to measuring Shareholders Value Creation have used parameters such as earnings capitalization,

Question:

What is EVA? Traditional approaches to measuring ‘Shareholder’s Value Creation’ have used parameters such as earnings capitalization, market capitalization and present value of estimated future cash flows. Extensive equity research has established that it is not earnings per se, but value that is important. A measure called ‘Economic Value Added’ (EVA) is increasingly being applied to understand and evaluate financial performance.

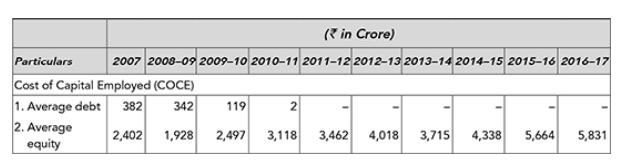

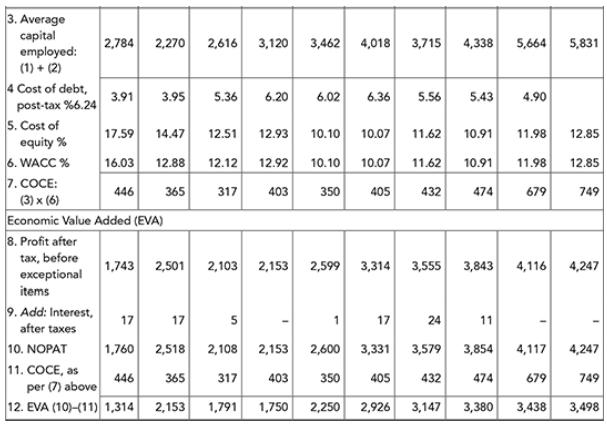

EVA = Net Operating Profit after taxes (NOPAT) − Cost of Capital Employed (COCE), where,

NOPAT = Profits after depreciation and taxes but before interest costs.

NOPAT thus represents the total pool of profits available on an ungeared basis to provide a return to lenders and shareholders, and COCE = Weighted Average Cost of Capital (WACC) × Average Capital Employed Cost of debt is taken at the effective rate of interest applicable to an ‘AAA’ rated company like HUL for a shortterm debt, net of taxes. We have considered a pre tax rate of 7.42% for 2016–17 (8.22% for 2015–16).

Cost of equity is the return expected by the investors to compensate them for the variability in returns caused by fluctuating earnings and share prices.

Cost of Equity = Risk free return equivalent to yield on longterm government bonds (taken at 6.68% for 2016–17)

(+)

Market risk premium (taken at 8.69%) (x) Beta variant for the company, (taken at 0.710) where Beta is a relative measure of risk associated with the company’s shares as against the market as a whole.

Thus HUL’s cost of equity = 6.68% + 8.69% (x) 0.710 = 12.85%

What does EVA show?

EVA is residual income after charging the company for the cost of capital provided by lenders and shareholders. It represents the value added to the shareholders by generating operating profits in excess of the cost of capital employed in the business.

When will EVA increase?

EVA will increase if:

1. Operating profits are made to grow without employing more capital, that is, greater efficiency.

2. Additional capital is invested in projects that return more than the cost of obtaining new capital, that is, profitable growth.

3. Capital is curtailed in activities that do not cover the cost of capital, that is, liquidate unproductive capital.

EVA in practice at Hindustan Unilever Limited

In Hindustan Unilever Limited, the goal of sustainable longterm value creation for our shareholders is well understood by all the business groups. Measures to evaluate business performance and to set targets take into account this concept of value creation.

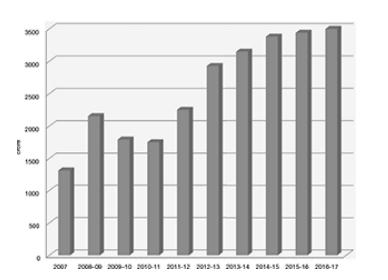

EVA Tends: 2007–2017 (Unaudited)

Economic Value Added (EVA) ( ₹ in Crore)

Questions for Discussion

1. How is EVA different from the conventional profit after tax (PAT)?

2. HUL’s EVA has increased over the years. Identify the main contributory factors towards improvement in EVA of the company?

3. How do you relate profitability, asset turnover and financial leverage with EVA?

Step by Step Answer: