Capstone Consolidated, Inc. is a leading manufacturer of steel products. The following inventory data relates to the

Question:

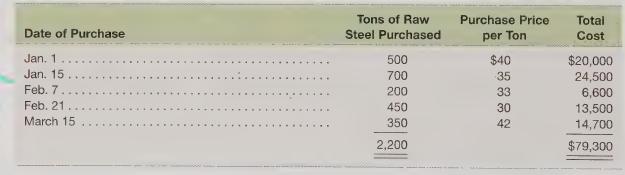

Capstone Consolidated, Inc. is a leading manufacturer of steel products. The following inventory data relates to the firm’s production during the first quarter of 2015:

At the end of the first quarter of 2015, Capstone’s internal auditors determined that 1,700 tons of raw steel had been processed and sold.

Reuired

1. Calculate the cost of steel processed and sold during the quarter under each of the following methods, assuming use of a periodic inventory management system:

a. EIFO

b. LIFE

c. Weighted-average

2. Assume that the replacement cost per ton is \($39\) at the end of the quarter. What amount should Capstone’s nding inventory be valued at on its March 31 balance sheet under each of the following methods?

a. FIFO

b. LIFO

c. Weighted-average 3. Which method—FIFO, LIFO, or the weighted-average cost method—should Capstone use for reporting its financial results to its shareholders? Why? How does this decision constrain the company’s method choice for income tax reporting?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris