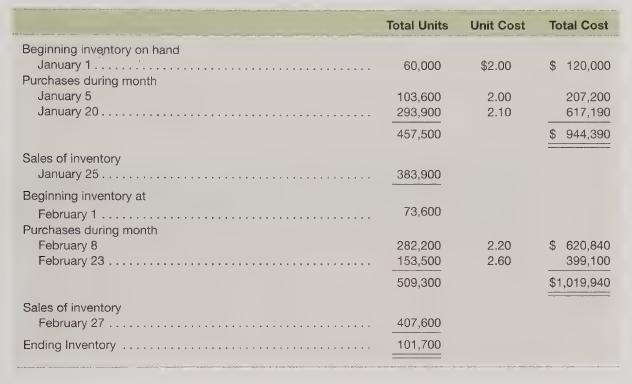

Consider the following inventory data for the first two months of the year for CompX International: Required

Question:

Consider the following inventory data for the first two months of the year for CompX International:

Required

1. Calculate the cost of goods sold and ending inventory for January and February under each of the following methods, assuming use of a perpetual inventory management system:

a. FIFO

b. LIFO

c. Weighted-average

2. Assume that the replacement cost of CompX International’s ending inventory is \($2.05\) per unit on January 30 and \($2.35\) per unit on February 28. Calculate the value of the ending inventory for January and February under each of the following methods:

a. FIFO

b. LIFO

c. Weighted-average 3. Which method—FIFO, LIFO, or the weighted-average cost method—should CompX International use when reporting its financial results to its shareholders? Why? How does this decision constrain the company’s method selection for income tax reporting?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris