Presented below is financial data for two companies that are identical yma in every respect except that

Question:

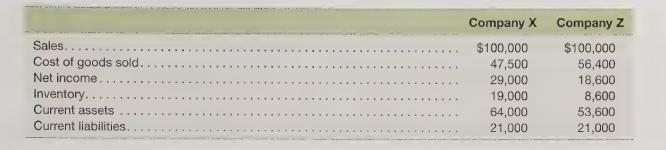

Presented below is financial data for two companies that are identical yma in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: