Manulife Financial is a large Canadian-based insurance and financial services company. with operations in Canada. United States.

Question:

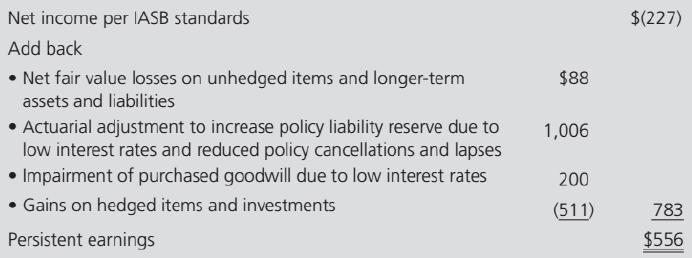

Manulife Financial is a large Canadian-based insurance and financial services company. with operations in Canada. United States. and Asia. Manulife's profits suffered from low interest rates and poor stock market returns following the 2007-2008 market meltdowns. These returns were less than the rates of return assumed by Manulife when setting pre-meltdown premiums for its insurance and other products. Much of the risk of a decline in interest rates and stock returns had not been hedged by Manulife. Subsequently, Manulife increased its hedging activity. In its third quarter, 2012, Manulife reported a net loss under IFRS accounting standards of $227 million. In this quarter, the company also began reporting an alternate earnings number, which it called core earnings, of $556 million for the quarter. Core earnings were calculated as follows:

Required

a. Manulife management claimed that their core earnings calculation gives a better picture of longer-term persistent earnings. Do you agree? Explain.

b. Which earnings measure-IFRS or core earnings-best helps investors to predict Manulife's future earnings performance? Explain.

c. The Conceptual Framework includes reporting on manager stewardship as a goal of financial reporting. Which measure best reports on manager stewardship? Explain.

d . On November 8, 2012, the day of Manulife's third quarter earnings release, the company's share price fell 18 cents to $11.82. On the same day, the S&P/TSX Composite Index fell to 12,197.05 from its open at 12,227.85. Manulife's beta, per Reuters Finance at the time, was 1.48. Assume that the daily risk-free interest rate was effectively zero. Assume securities markets efficiency. Also assume that no other significant firm-specific information about Manulife became available on November 8. As evidenced by its share price performance, did the market approve or disapprove of Manulife's calculation of core earnings? Explain, and show calculations.

Step by Step Answer:

Financial Accounting Theory

ISBN: 9780134166681

8th Edition

Authors: William R. Scott, Patricia O'Brien