A, B and C are partners sharing profits and losses in the ratio of 6 : 5

Question:

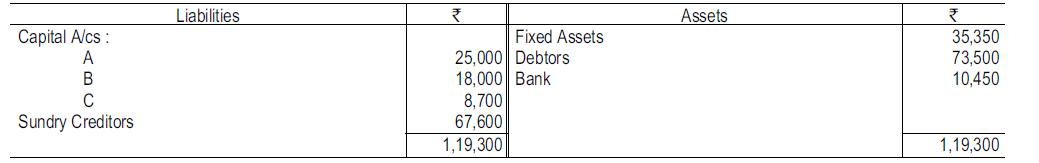

A, B and C are partners sharing profits and losses in the ratio of 6 : 5 : 3. Work-in-progress was not brought into the accounts. The Balance Sheet of the partnership as on 31.3.2018 showed the following position : On the above date, A retired from the partnership and it was agreed to admit D as a partner on the following terms:

On the above date, A retired from the partnership and it was agreed to admit D as a partner on the following terms:

1. Goodwill was agreed at ₹13,720 and it is to be adjusted accordingly.

2. A is to take his car out of the partnership assets at an agreed value of ₹1,000. The car had been included in the accounts as on 31.3.2018 at a written-down value of ₹594.

3. Although work-in-progress had not been and will not be included in the partnership accounts, the new partners were to credit A with his share based on an estimate that work-in-progress was equivalent to 20% of the debtors.

4. The new partnership of B, C and D were to share profits in the ratio of 5 : 3 : 2. The initial capital of ₹25,000 subscribed in the profit-sharing ratio.

5. B, C and D were each to pay A the sum of ₹5,000 out of their personal resources in part repayment of his share of the partnership.

6. A to lend to D any amount required to make up his capital in the firm from the money due to him, and any further balance due to A was to be left in the new partnership as a loan bearing, interest at 9% p.a. Any adjustment required to the Capital Accounts of B and C were to be paid into or withdrawn from the partnership Bank Account.

You are required to prepare the Partners’ Capital Accounts and the Balance Sheet.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee