Avon Products, Inc., is a leading manufacturer and marketer of beauty products and related merchandise. The company

Question:

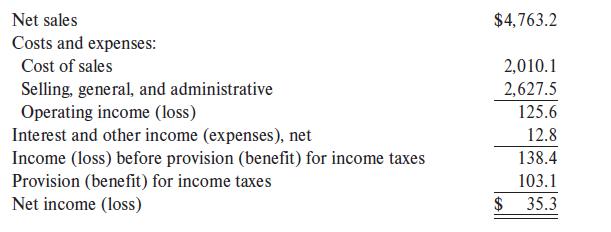

Avon Products, Inc., is a leading manufacturer and marketer of beauty products and related merchandise. The company sells its products in 79 countries through a combination of direct selling and use of individual sales representatives. Presented here is an earlier year’s income statement (dollars in millions).

Avon’s beginning and ending total assets were $3010.1 and $3086.3, respectively.

Required:

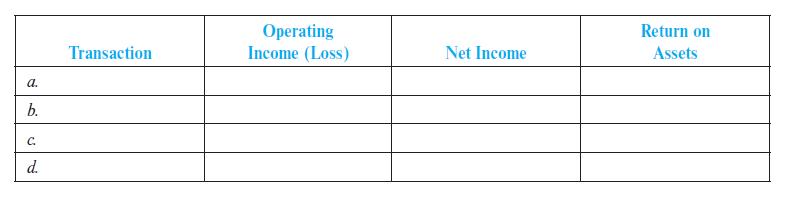

1. Listed below are hypothetical additional transactions. Assuming that they also occurred during the fiscal year, complete the following tabulation, indicating the sign of the effect of each additional transaction (+ for increase, − for decrease, and NE for no effect). Consider each item independently and ignore taxes.

a. Recorded and received additional interest income of $7.

b. Purchased $80 of additional inventory on open account.

c. Recorded and paid additional advertising expense of $16.

d. Issued additional shares of common stock for $40 cash.

2. Assume that next period, Avon does not pay any dividends, does not issue or retire stock, and earns 20 percent more than during the current period. If total assets increase by 5 percent, will Avon’s ROA next period be higher, lower, or the same as in the current period? Why?

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge