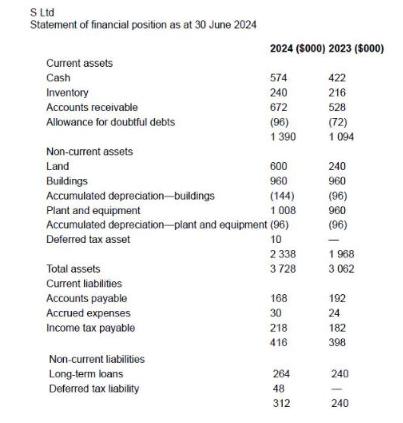

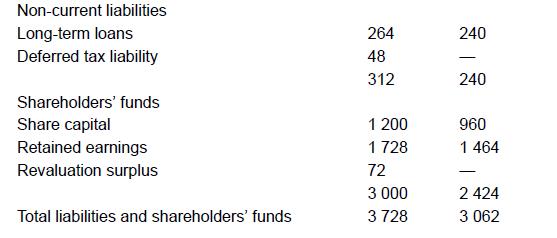

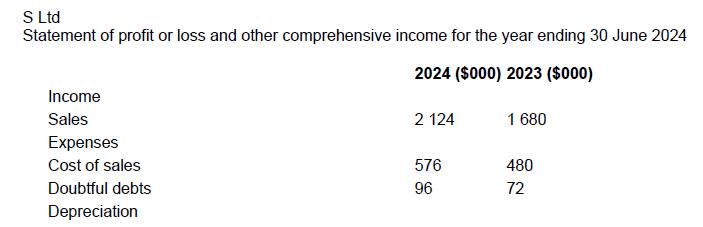

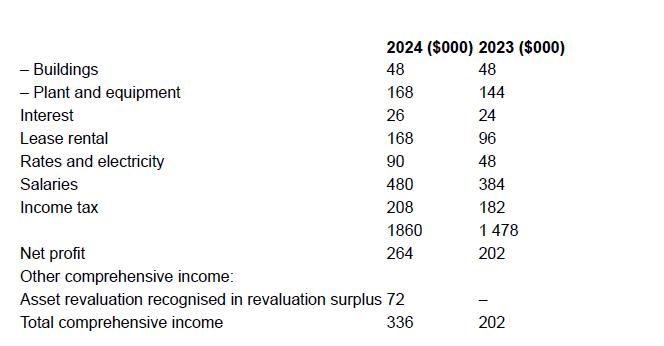

Following are extracts from the accounting records of S Ltd at 30 June 2024: Additional information During

Question:

Following are extracts from the accounting records of S Ltd at 30 June 2024:

Additional information

During the year, land with a fair value of $240 000 is acquired through the issue of 240 000 fully paid shares.

There is an upward revaluation by $120 000 of land previously held.

There are no cash sales during the year.

Debtors of $72 000 previously provided for as doubtful were written off during the year.

The following expenses are paid as incurred:

1 – electricity

2 – rates

3 – interest.

Accruals of lease rentals and salaries are made before payment.

Depreciation allowable for tax purposes for the year was:

1– Buildings: no allowable tax depreciation

2– Plant and equipment: $168 000 tax depreciation.

Plant costing $240 000 is sold during the year for $72 000. Accumulated depreciation at the time of sale is $168 000.

The accounts payable account is used for inventory purchases.

Assume a tax rate of 40 per cent.

REQUIRED

Prepare a statement of cash flows for S Ltd for the year ending 30 June 2024, in accordance with AASB 107 (comparative figures are not required).

Step by Step Answer: