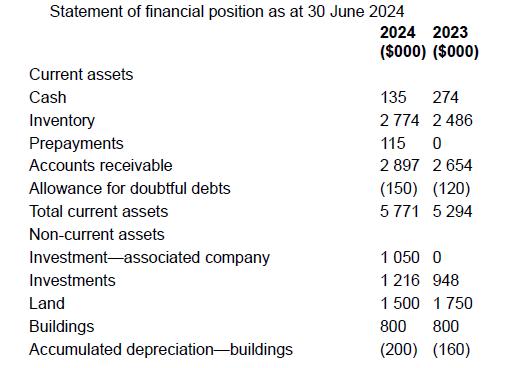

Pty Ltd is a manufacturer of tennis equipment and fashion wear. The statement of financial position as

Question:

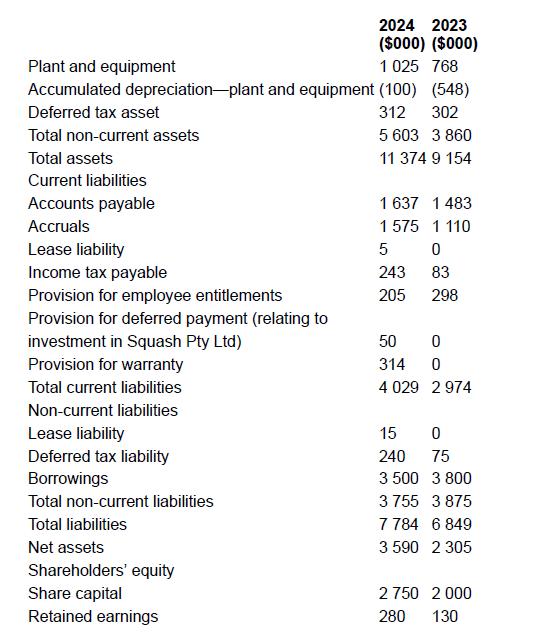

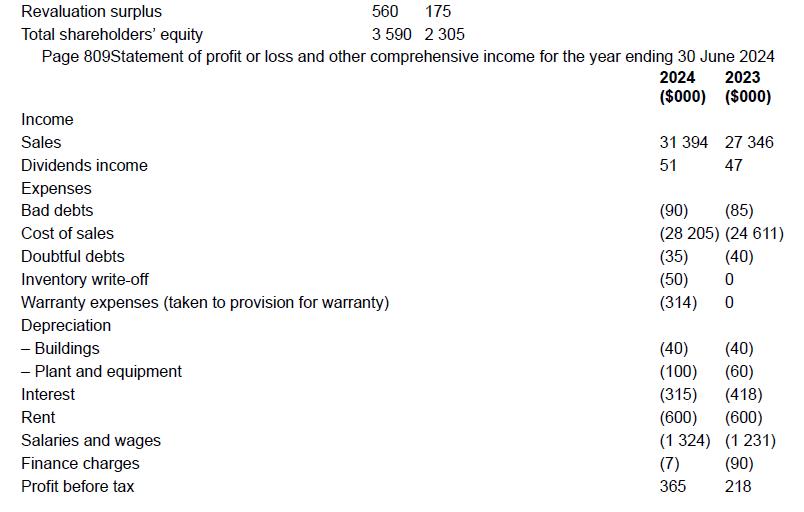

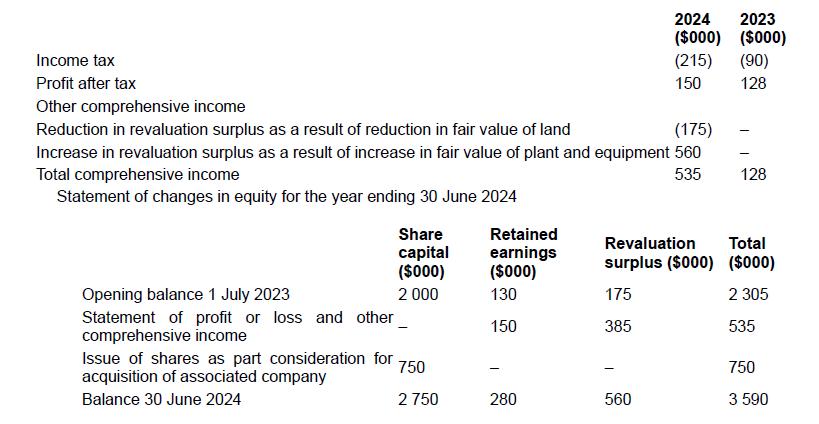

Pty Ltd is a manufacturer of tennis equipment and fashion wear. The statement of financial position as at 30 June 2024 and details of expenses and revenues for the year ending 30 June 2024 are as follows:

Additional information

An additional investment of $80 000 is acquired for consideration of tennis equipment costing $80 000. Land is devalued against a previous increment in the revaluation reserve. The previous increment is fully reversed.

Plant and equipment with a cost of $700 000 and accumulated depreciation of $500 000 are revalued to $1 000 000 during the year.

Plant and equipment with a fair value of $25 000 are acquired under a finance lease. The residual is guaranteed by the lessee.

Plant and equipment are sold for $20 000 cash. Cost is $68 000 and no profit or loss is made on the sale.

During the year, one line of wooden tennis racquets is scrapped at a loss of $50 000, as there is little demand for this range.

During the year, an investment is made in an associated company, Squash Pty Ltd. Consideration is

$1 000 000, funded by cash of $250 000 and the balance by the issue of 500 000 shares at $1.50 per share. The purchase agreement includes a clause stating that if profits exceed $110 000 in the first financial year after purchase, additional amounts are payable. Using the formula, an extra $50 000 is provided.

Provision for warranty is based on 1 per cent of sales.

Rent expense of $600 000 is accrued within ‘Accruals’.

Interest expense is paid during the year and dividends are received.

Salaries and wages expense includes the expense for employee entitlements.

The tax rate is 30 per cent.

REQUIRED

Prepare the statement of cash flows in accordance with AASB 107 for the year ending 30 June 2024. Comparatives are not required

Step by Step Answer: