In the year 2010, Link Limited (LL) acquired substantial stake in Monk Limited (ML). However, financial accountant

Question:

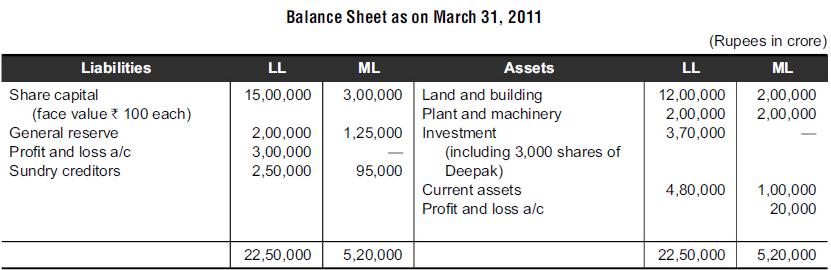

In the year 2010, Link Limited (LL) acquired substantial stake in Monk Limited (ML). However, financial accountant could not understand the difference between substantial stake and earlier investment in ML. He continued to show the investment as earlier as if ML was an associate of LL.

This point was challenged by assessing officer in the income tax department and he returned the individual financial statements of both the companies. The statements are as follows:

Additional information

(i) LL acquired the investment at a cost of ₹3,10,000 in ML on October 1, 2010.

(ii) The general reserve of ML as displayed in the balance sheet is as on the date of acquisition.

(iii) ML incurred a loss of ₹20,000 for the year.

(iv) The fair value of land and building of LL and ML has increased by 20% over the book value and for plant and machinery there has been an increase by 10% for LL but a decrease by 20% for ML.

(v) Both the companies provided depreciation of land and building by 5% and on plant and machinery by 10%.

Discussion Question

(i) Prepare consolidated financial statement as if fair value is not given.

(ii) Prepare consolidated financial statement when fair value is given as above.

(iii) How should LL report the investment in its financial statements when it has only 30% of ML at a cost of ₹95,000?

(iv) How should LL should prepare consolidated financial statement when it holds 80% shares of ML acquired at ₹2,50,000?

Step by Step Answer: