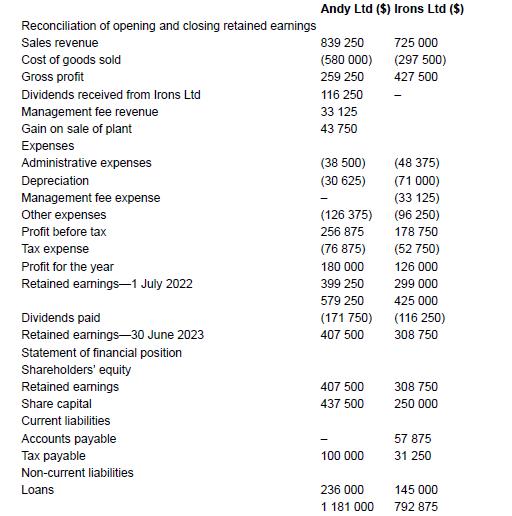

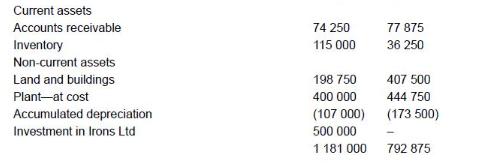

The following financial statements of Andy Ltd and its subsidiary Irons Ltd have extracted from their financial

Question:

The following financial statements of Andy Ltd and its subsidiary Irons Ltd have extracted from their financial records at 30 June 2023.

- Other information

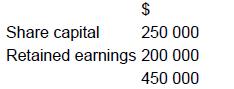

Andy Ltd acquired its 100 per cent interest in Irons Ltd on 1 July 2016—that is, seven years earlier. The cost of the investment was $500 000. At that date the capital and reserves of Irons Ltd were: At the date of acquisition all assets were considered to be fairly valued.

At the date of acquisition all assets were considered to be fairly valued.

- During the year Andy Ltd made total sales to Irons Ltd of $81 250, while Irons Ltd sold $65 000 in inventory to Andy Ltd.

- The opening inventory in Andy Ltd as at 1 July 2022 included inventory acquired from Irons Ltd for $52 500 that cost Irons Ltd $43 750 to produce.

- The closing inventory in Andy Ltd includes inventory acquired from Irons Ltd at a cost of $42 000. This cost Irons Ltd $35 000 to produce.

- The closing inventory of Irons Ltd includes inventory acquired from Andy Ltd at a cost of $15 000. This cost Andy Ltd $12 000 to produce.

- The management of Andy Ltd believe that goodwill acquired was impaired by $3750 in the current financial year. Previous impairments of goodwill amounted to $200000.

- On 1 July 2022 Andy Ltd sold an item of plant to Irons Ltd for $145 000 when its carrying amount in Andy Ltd’s accounts was $101 250 (cost $168 750, accumulated depreciation $67 500). This plant is assessed as having a remaining useful life of six years. The Group has a policy of measuring its property, plant and equipment using the ‘cost model’. The group uses the straight-line method of depreciation.

- Irons Ltd paid $33 125 in management fees to Andy Ltd.

- The tax rate is 30 percent.

REQUIRED

Prepare the consolidated statement of financial position and consolidated statement of profit or loss and other comprehensive income of Andy Ltd and Irons Ltd as at 30 June 2023. Also provide a statement of changes in equity.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: