We had come across a firm with large number of subsidiaries in Chapter 3 (see Mini Case

Question:

We had come across a firm with large number of subsidiaries in Chapter 3 (see Mini Case 3.7), namely, Jignesh Shah promoted Financial Technologies India Limited (FT). The National Spot Exchange Limited (NSEL), a spot commodity exchange, was a subsidiary promoted by the FT. The NSEL crisis erupted in August 2013 after it was found that the exchange was in no position to honor payouts worth ₹5,500 crore to its investors and the underlying stock was woefully short against the receipts issued.

Mukesh P Shah who is a maternal uncle of Jignesh Shah has been internal as well as external auditor of NSEL from time to time including FY2013. Investigations by Mumbai Police revealed that that Mukesh P Shah was not only owning the shares of FT but also doing insider-trading in FT shares. Besides, Mumbai police also confirmed that most companies owning shares of FT were registered at the address of Mukesh Shah. Further, Mukesh Shah was the auditor of all these companies which traded on NSEL to the tune of ₹1,352 crore and moved out in May–June 2013 without losing a penny showing their knowledge of the scam.

A high-level government team under the then economic affairs secretary Arvind Mayaram, set up by the finance minister in August 2013, had reported “possible violations” by entities such as “auditors in due-diligence”. The panel, which gave its recommendations in September 2013, said action needed to be initiated over “failure to furnish a true and fair view of the state of affairs at NSEL in its balance sheet for the financial year ended March 2013”. When Deloitte, Haskins & Sells, the auditor of NSEL’s parent, FT, came to know about this, it informed FT that accounts of the parent, too, could not be relied on. Thus, popular media suggests that NSEL scam were a systematic and premeditated fraud perpetrated in the commodity market. It was a Ponzi scheme wherein over 13,000 investors lost about ₹5,600 crores. The ICAI, the licensing and regulatory body for accountants, is examining the role of auditors in the default at NSEL. Surprisingly, an associate of global accounting firm Ernst & Young in India, SV Ghatalia & Associates, auditors of the beleaguered National Spot Exchange (NSEL) for FY2012, was been kept outside the purview of scrutiny by the ICAI. The new Managing Director, Anjani Sinha, had stated publicly that the fraud has been going on for past few years. Inspite of this ICAI decided to close its eyes raising doubts in the eyes of regulators and other stakeholders. The sequence of events also brought the issue of investigation of any audit firm must be done by an independent body and not by ICAI as it is related party where auditors are its members.

Time flew. In 2015, six months after a Delhi High Court order in the matter, NSEL investor IGL Finance initiated contempt of court proceedings against the ICAI and its disciplinary committee for not completing the proceedings in complaints against Mukhesh P Shah & Co. Immediately, within a week, ICAI released the disciplinary committee findings.

(a) Based on the above limited discussion – identify the corporate governance issues from a financial reporting perspective. Also, identify the stakeholders who would have suffered in the process (and how).

(b) List the internal auditor’s role in NSEL. How feasible would be for a related party to perform the same? Suggest the traits of an ideal person/party that should have been part of this team at the NSEL.

(c) List the external auditor’s role in NSEL. How feasible would be for a related party to perform the same? Suggest the traits of an ideal person/party that should have been part of this team at the NSEL

(d) Can the internal auditor also act as the external auditor? Comment.

Data from Chapter 3 Mini Case 3.7:

Financial Technologies Limited was promoted in 1988 by a first generation entrepreneur named Jignesh Shah. The firm and its arms (commonly known as FT group) went on to become a global leader in offering technology and domain expertise to create and trade on next-generation financial markets, across all asset classes including equities, commodities and currencies among others. FT had a market value of over ₹15,000 crore in FY2012.

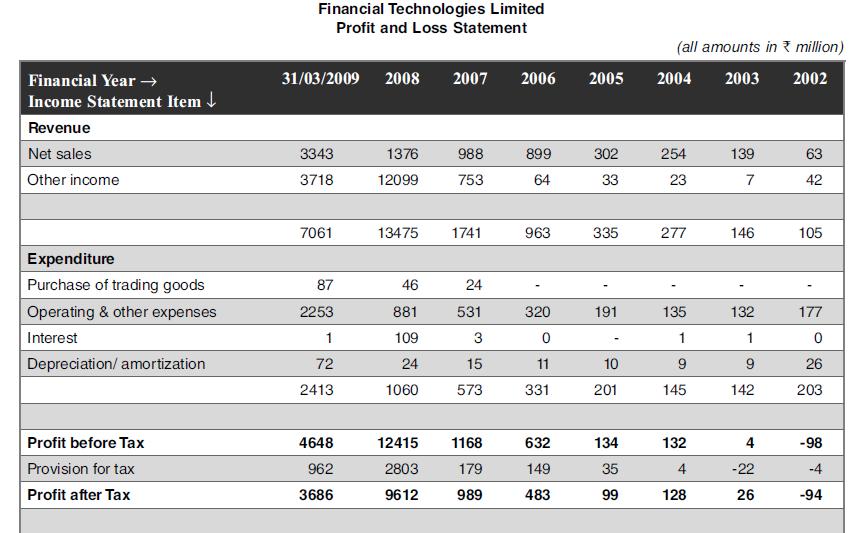

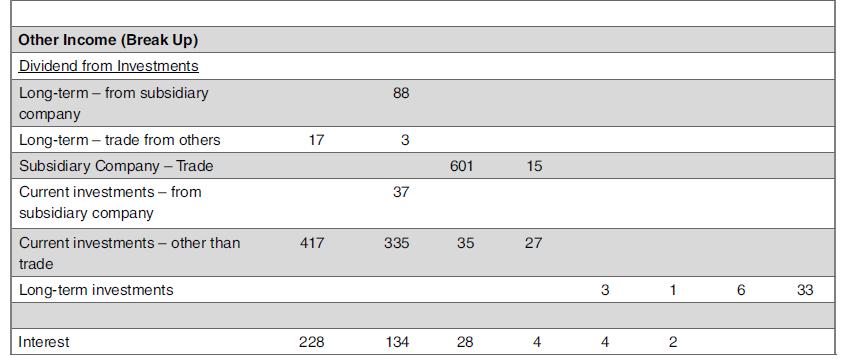

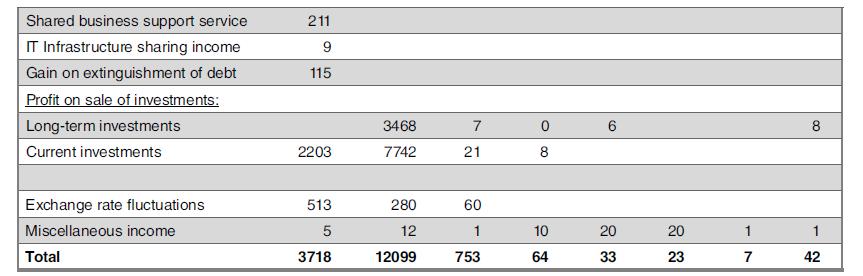

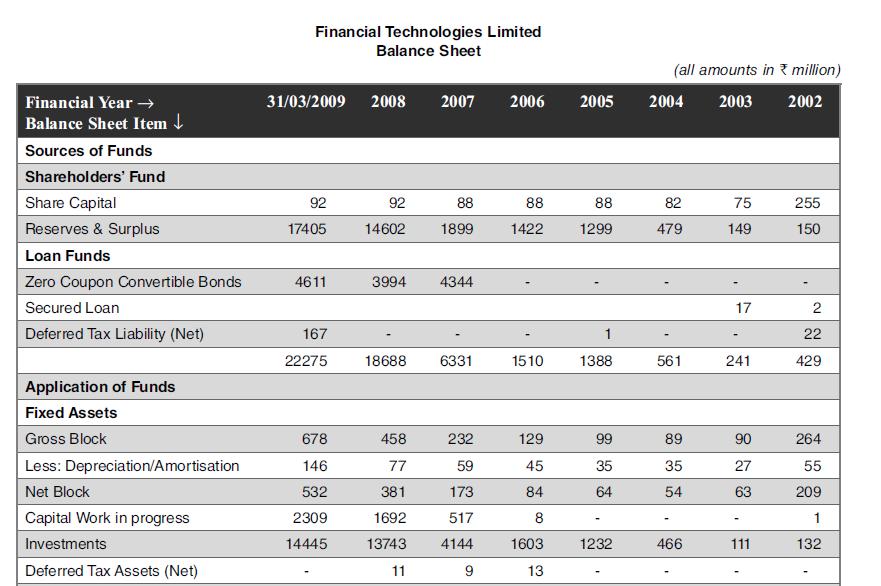

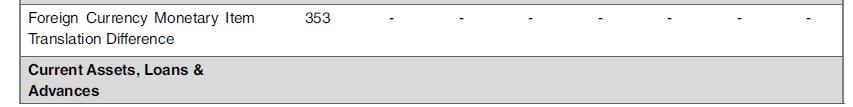

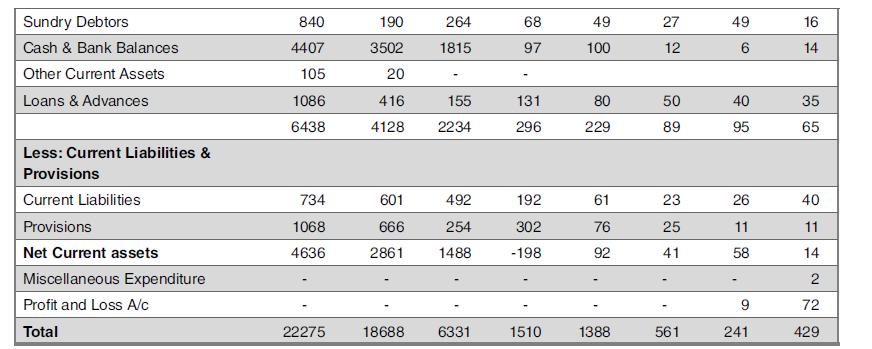

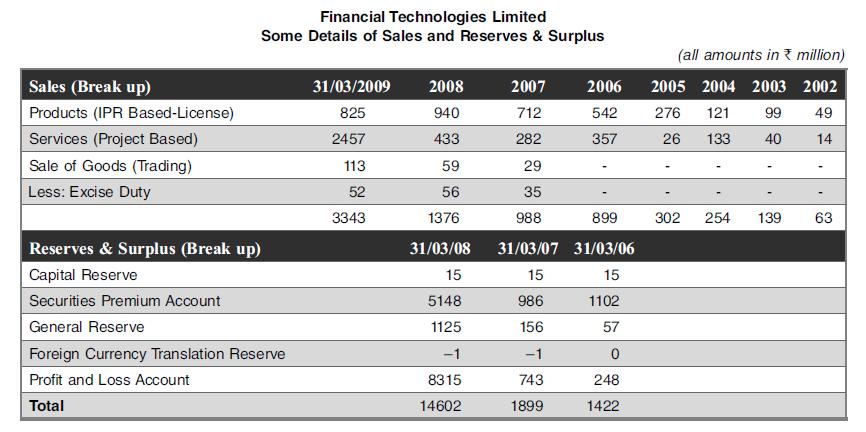

Given below are the two standalone financial statements, i.e., profit and loss account and balance sheet of Financial Technologies (India) Ltd, for the period FY2002-09. Please go through them and answer the questions.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani