X, Y and Z, carrying on business from 1980, decided to dissolve their partnership on June 30,

Question:

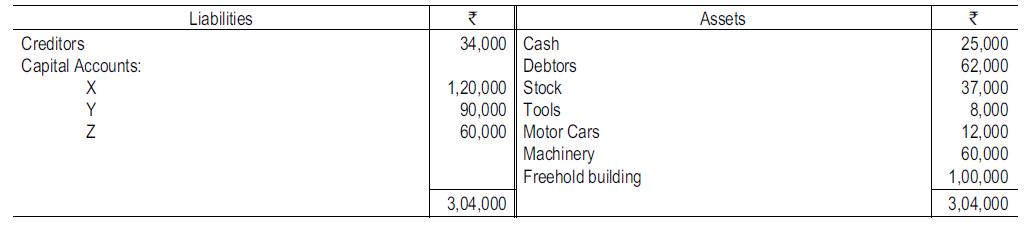

X, Y and Z, carrying on business from 1980, decided to dissolve their partnership on June 30, 2018, when their Balance Sheet was as under: Y and Z agreed to form a new partnership to carry on the business and agreed that they shall acquire from the old firm the following assets at the amounts shown: Stock ₹40,000; Tools ₹5,000; Motor cars ₹25,000; Machinery ₹78,000; Freehold building ₹84,000; and Goodwill ₹60,000. The partnership agreement of X, Y and Z provided that trading profits or losses shall be divided in the ratio of 3 : 2 : 1 and that capital profits or losses shall be divided in proportion to their capitals. Debtors realise ₹59,000 and discount amounting to ₹720 is secured on payments due to creditors. Prepare the necessary accounts of X, Y and Z giving effect to these transactions and prepare the opening Balance Sheet of Y and Z who bring the necessary cash to pay X in the ratio of 3 : 2.

Y and Z agreed to form a new partnership to carry on the business and agreed that they shall acquire from the old firm the following assets at the amounts shown: Stock ₹40,000; Tools ₹5,000; Motor cars ₹25,000; Machinery ₹78,000; Freehold building ₹84,000; and Goodwill ₹60,000. The partnership agreement of X, Y and Z provided that trading profits or losses shall be divided in the ratio of 3 : 2 : 1 and that capital profits or losses shall be divided in proportion to their capitals. Debtors realise ₹59,000 and discount amounting to ₹720 is secured on payments due to creditors. Prepare the necessary accounts of X, Y and Z giving effect to these transactions and prepare the opening Balance Sheet of Y and Z who bring the necessary cash to pay X in the ratio of 3 : 2.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee