DEF Products Ltd manufactures and assembles one type of furniture unit. The following information is available for

Question:

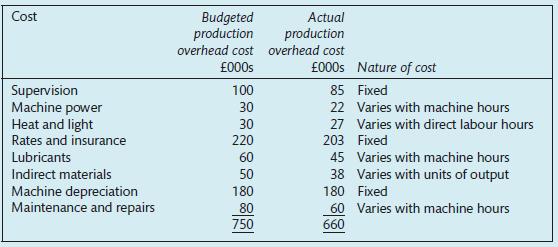

DEF Products Ltd manufactures and assembles one type of furniture unit. The following information is available for the year ended 31 August Year 7. The budgeted costs and the actual costs incurred during the year were as follows:

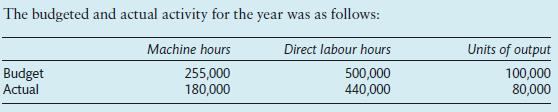

At the end of the year, the production director made the following report to his colleagues on the board of directors: ‘We budgeted for £750,000 overhead cost based on 500,000 direct labour hours. We incurred £660,000 actual cost but only worked 440,000 hours. This appears to me to be a satisfactory proportionate reduction in costs and there are consequently no adverse variances from budget to be explained.’

The other directors felt this comment ignored the distinction between fixed overhead cost and variable overhead cost. They were also concerned that the production director referred only to the fall in direct labour hours worked, when it was known that some overheads depended on the number of machine hours worked. They asked for a more detailed analysis of the expected level of overhead costs in relation to the activity levels achieved.

Required

Prepare a memorandum to the production director:

(a) Proposing, with reasons, a suitable method for calculating overhead cost rates;

(b) Setting out a variance analysis which distinguishes fixed overheads from variable overheads.

Step by Step Answer:

Financial And Management Accounting An Introduction

ISBN: 9781292244419

8th Edition

Authors: Pauline Weetman