Hydrangea, Inc., is a maker of silk floral arrangements that are sold in high-end flower shops. The

Question:

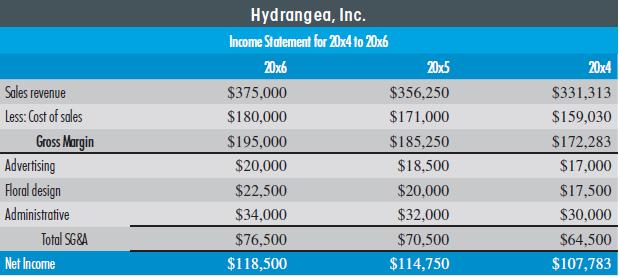

Hydrangea, Inc., is a maker of silk floral arrangements that are sold in high-end flower shops. The company is thinking about expanding after a year of record sales that really stretched existing resources to their maximum. The results of the last three years of business are shown in the table below. The company is looking at four different ways to grow its business:

The company is looking at four different ways to grow its business:

• Scenario 1: Buy an additional store. It would require a onetime investment of $50,000 to get the store ready for operation. The operating costs (cost of sales) would go up by 40% over 20x6. Revenues would increase 60%. All three SG&A costs would also go up. Advertising would increase $10,000, floral design $12,000, and administrative by $6,000.

• Scenario 2: Rent the building next to the existing store. This would require a onetime cost of $15,000 to get the space ready. Sales would increase 20%. Cost of sales would increase 15%. Advertising would go up $5,000. Floral design and administrative costs would remain the same.

• Scenario 3: Expand the existing business by adding hours and squeezing in another two coolers for flowers. This would require an outlay of $5,000 for the coolers. Advertising would increase $5,000. Sales revenue would increase 5%, and cost of sales would remain steady. Floral design and administrative costs would remain unchanged.

• Scenario 4: Do nothing. Next year’s revenues and cost of sales would remain constant compared to 20x6. Advertising would increase $5,000 to ensure sales stay at the existing high level.

REQUIRED:

a. Develop income statements for the four scenarios.

b. What would you recommend that the company do? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant