Having decided to use his most likely scenario as the plan for 20x7, Jack decides to develop

Question:

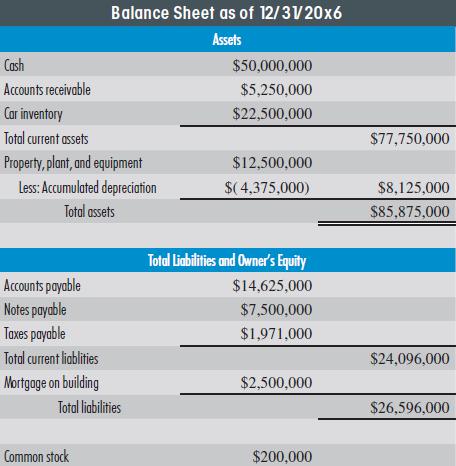

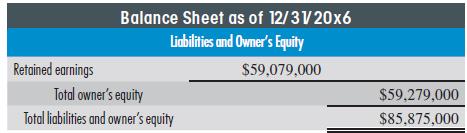

Having decided to use his most likely scenario as the plan for 20x7, Jack decides to develop cash forecasts. The opening balance sheet is presented below.

OTHER INFORMATION:

OTHER INFORMATION:

• The company pays its taxes quarterly on the prior quarter’s income. That means the ending taxes payable is always the total taxes payable from the prior quarter. Prestige ends the year owing 25% of 20x6’s income taxes, which must be paid in March of the first quarter of the following year. Assume 25% of 20x7’s projected taxes are in taxes payable at the end of Quarter 1.

• Accounts payable are always paid the month following the cost. This is mostly the cost of acquiring the automobiles the company sells.

• The company plans to sell $9,000,000 of new and used cars over the first quarter of 20x7. It plans to sell $2,000,000 in January, $2,500,000 in February, and $4,500,000 in March. It will collect 75% of these sales in cash either from the customer directly or from the loan company servicing the customer. The remaining 25% of the sales are in Accounts Receivable in the form of a bridge loan collected according to the instruction below.

• The cars sold cost the company 65% of their selling price. The company pays for these purchases in the month following the purchase. This is the opening accounts payable balance.

• Repairs revenue is planned to come in evenly throughout the year, so one twelfth of the annual total will be collected in cash (all repairs revenues are cash-based) in each month.

• The company pays for 50% of the cost of purchased cars in the month of sale and 50% the next month.

• All other variable and fixed costs are paid in the month they are incurred. Remember: Under the most likely scenario, variable costs are 1.05 times 15%, or 15.75%. Used cars variable costs remain at 15% and repairs variable costs go up 5%, 20% times 1.05, or 21%. Prestige incurs repairs variable costs uniformly over the 12 months of operations.

• It also incurs fixed costs uniformly over the 12 months of operations.

• Annual depreciation, included in the overhead costs, comes to $200,000 of these fixed costs.

• The accounts receivable consists of short-term notes that are used to help some customers finance the original purchase of the cars from the dealership. Of the opening balance of $125,000, 70% will be collected in January, the remainder in March. Of the sales made, 25% require an accounts receivable bridge loan, while the rest are cash sales. Customers who take the bridge loan pay 25% in the month of sale, 45% in the month after sale, and 30% two months after the sale.

• Prestige is scheduled to make a $10,000 payment on its notes payable every month. The note was originally valued to include interest, so no separate cash entry is required for the interest on the note.

REQUIRED:

Using the template provided for the first three months of 20x7 (called Temple 20173 months), develop a cash receipts budget, a cash disbursements budget, and a total cash budget. Also calculate ending accounts receivable, ending taxes payable, and ending accounts payable. Place them in the box provided on the template. Finally, when you turn in your completed template, include a comment on how Prestige Auto’s cash projections look for the first quarter of 20x7.

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant