Determine the best decision in each of the following separate situations. For each decision, assume the company

Question:

Determine the best decision in each of the following separate situations. For each decision, assume the company has sufficient excess capacity.

Production Decisions

1. Make or Buy. Green Co. uses part \(J J\) in manufacturing its products. It currently buys this part for \(\$ 40\) per unit. Making the part would require direct materials of \(\$ 11\) per unit and direct labor of \(\$ 15\) per unit (1 direct labor hour per unit). Green normally applies overhead using a predetermined overhead rate of \(\$ 30\) per direct labor hour. Making the part would require incremental overhead of \(\$ 17\) per direct labor hour. Should Green make or buy the part?

2. Sell or Process. Gold Co. makes a product that can be either sold as is or processed further. The company has already spent \(\$ 75,000\) to produce 10,000 units that can be sold as is for \(\$ 100,000\). Instead, the units can be processed further at a cost of \(\$ 80,000\), and then sold for \(\$ 220,000\). Should Gold sell the 10,000 units as is or process them further?

3. Scrap or Rework. Packer Co. has already spent \(\$ 90,000\) to produce 1,200 defective earbuds. A salvage company will buy the earbuds as is for \(\$ 66,000\). Instead, Packer can rework the earbuds for \(\$ 30,000\) and sell them for \(\$ 120,000\). Should Packer scrap or rework the earbuds?

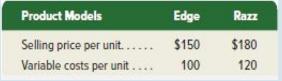

4. Sales Mix. Champ Co. can sell all units of both types of scooters it produces, but it has capacity of only 900 machine hours. The Edge model uses two machine hours per unit and the Razz model uses three machine hours per unit. Selling prices and variable costs per unit follow. Compute the contribution margin per machine hour for each product and then determine the best sales mix.

Capacity Decisions

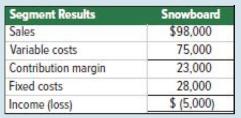

5. Segment Elimination. Badger \(\mathrm{Co}\). is considering eliminating its snowboard division as it shows a \(\$ 5,000\) loss for the year (see below). All its variable costs are avoidable, and \(\$ 25,000\) of its fixed costs are avoidable. Compute the income increase or decrease from eliminating this segment. Should the division be eliminated?

6. Keep or Replace. Buckeye Inc. has an old machine with a book value of \(\$ 95,000\) and a remaining five-year useful life. Buckeye can sell this old machine today for \(\$ 70,000\). The old machine has variable manufacturing costs of \(\$ 26,000\) per year. A new machine can be purchased for \(\$ 115,000\). The new machine would reduce variable manufacturing costs by \(\$ 16,000\) per year over its five-year useful life. Should Buckeye keep or replace the old machine?

Pricing Decisions

7. Total Cost Pricing. LA Surf sells surfboards. Each surfboard requires direct materials of \(\$ 55\), direct labor of \(\$ 35\), variable overhead of \(\$ 20\), and variable selling, general, and administrative costs of \(\$ 20\). Fixed overhead costs are \(\$ 90,000\) per year and fixed selling, general, and administrative costs are \(\$ 120,000\) per year. The company plans to produce and sell 1,000 surfboards in the next year. Compute the selling price per unit if LA Surf uses a markup of \(20 \%\) of total cost.

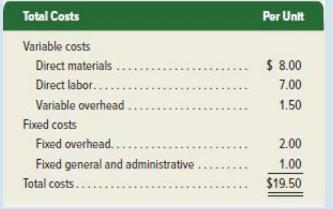

8. Special Offer Pricing. Marlin Co. produces and sells fishing rods for \(\$ 35\) each. Per unit costs follow. A foreign company has offered to buy 10,000 units at \(\$ 22\) each. If Marlin accepts this special offer, it will incur \(\$ 2,000\) of incremental fixed overhead costs and \(\$ 5,000\) of incremental fixed general and administrative costs. Should Marlin accept the special offer?

Step by Step Answer: