E. I. Du Pont De Nemours and Co.'s 10-K report has the following disclosures related to its

Question:

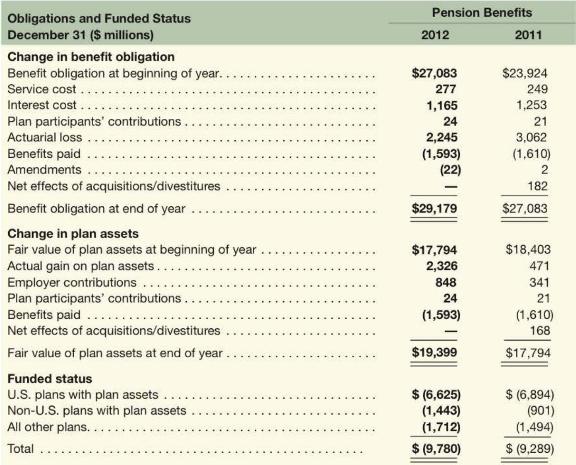

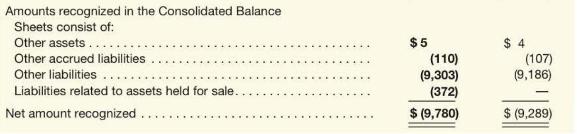

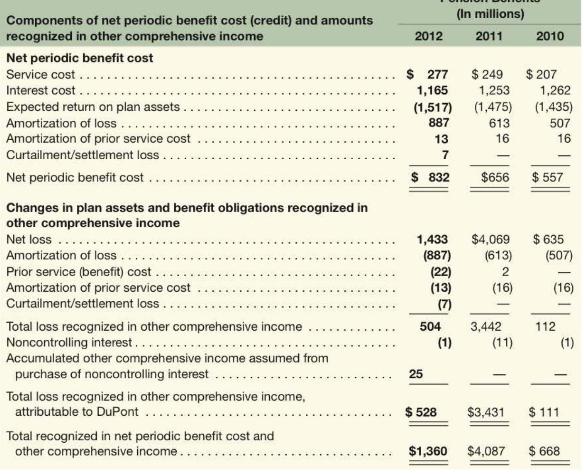

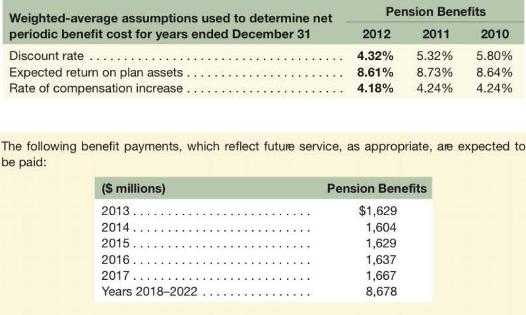

E. I. Du Pont De Nemours and Co.'s 10-K report has the following disclosures related to its retirement plans (\$ millions).

Required

a. How much pension expense (revenue) does DuPont report in its 2012 income statement?

b. DuPont reports a \(\$ 1,517\) million expected return on pension plan assets as an offset to 2012 pension expense. Approximately, how is this amount computed (estimate from the numbers reported)? What is DuPont's actual gain or loss realized on its 2012 pension plan assets? What is the purpose of using this expected return instead of the actual gain or loss (return)?

c. What main factors (and dollar amounts) affected DuPont's pension liability during 2012? What main factors (and dollar amounts) affected its pension plan assets during 2012?

d. What does the term funded status mean? What is the funded status of the 2012 DuPont pension plans?

e. DuPont decreased its discount rate from \(5.32 \%\) to \(4.32 \%\) in 2012 . What effect(s) does this decrease have on its balance sheet and its income statement?

f. How did DuPont's pension plan affect the company's cash flow in 2012? (Identify any inflows and outflows, including amounts.)

g. Explain how the returns on pension assets affect the amount of cash that DuPont must contribute to fund the pension plan.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton