FedEx Corp. reports total assets of $24,902 and total liabilities of $11,091 for 2013 ($ millions). Its

Question:

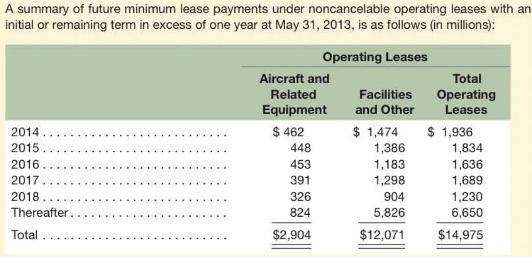

FedEx Corp. reports total assets of \$24,902 and total liabilities of \$11,091 for 2013 (\$ millions). Its FedEx Corp. (FDX) \(10-\mathrm{K}\) report has the following footnote related to leasing activities.

Required

a. What is the balance of lease assets and lease liabilities reported on FedEx's balance sheet? Explain.

b. Assume FedEx uses a rate of \(4.8 \%\) to discount its capital leases. Use this discount rate and round the remaining lease life to two decimals to estimate the amount of assets and liabilities that FedEx fails to report as a result of its off-balance-sheet lease financing.

c. What adjustments would we make to FedEx's income statement corresponding to the adjustments we make to its balance sheet in part \(b\) ?

d. Indicate the direction (increase or decrease) of the effect that capitalizing the operating leases would have on the following financial items and ratios for FedEx: return on equity (ROE), net operating profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset turnover (NOAT), and measures of financial leverage.

e. What portion of total lease liabilities did FedEx report on-balance-sheet and what portion is offbalance-sheet?

f. Based on your analysis, do you believe that FedEx's balance sheet adequately reports its aircraft and facilities assets and related obligations? Explain.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton