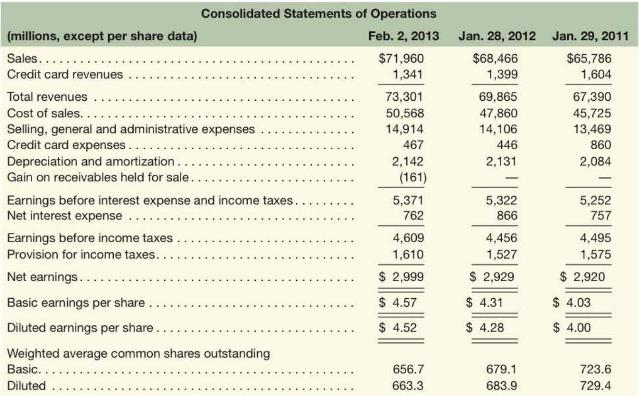

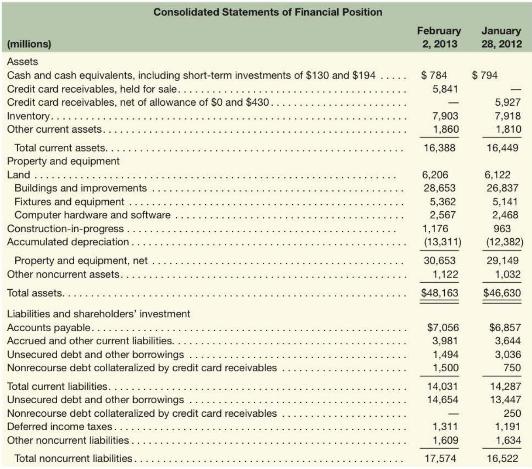

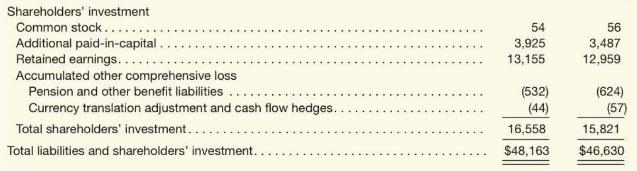

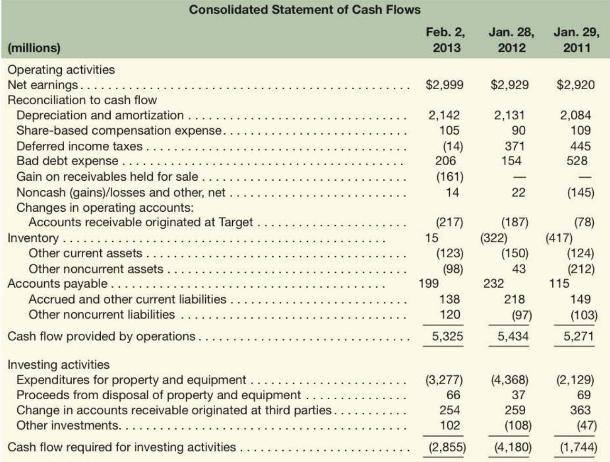

Following are the financial statements of Target Corp. Required Forecast Target's fiscal year ended 2014 and 2015

Question:

Following are the financial statements of Target Corp.

Required

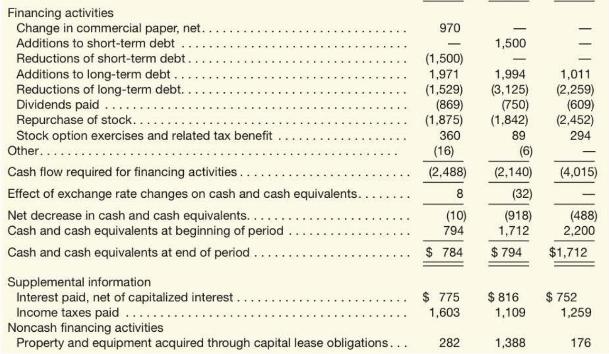

Forecast Target's fiscal year ended 2014 and 2015 income statements, balance sheets, and statements of cash flows. Round revenue growth to the nearest whole percent and round forecasts to \(\$\) millions. Assume credit card revenue growth is the same as the sales revenue growth. Use the same forecasting assumptions for both years; estimate forecasted income statement relations to 3 decimal places, for example, Other current assets/Sales is \(2.6 \%\) (assume no change for: interest expense, deferred tax liability, common stock, additional paid-in capital, and accumulated other comprehensive loss). Target's long-term debt footnote indicates maturities of \(\$ 2,001\) million in fiscal year ended 2014, \$1,001 million in fiscal year ended 2015, and maturities of \(\$ 27\) million in fiscal year ended 2016. Hint: Nonrecourse debt is interest bearing debt. The outstanding debt of \(\$ 1,500\) million is included in the current maturities of \(\$ 2,001\) million for fiscal year ended 2014 (assume no additional debt will be acquired). The remaining \(\$ 501\) is unsecured debt and other borrowings. Assume a 1.5\% rate for return on investments and a \(4.3 \%\) rate for interest bearing debt. Also assume no gain on receivables in future years. What investment or financing assumptions are required for forecasting purposes? What is our assessment of Target's financial condition over the next two years?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton