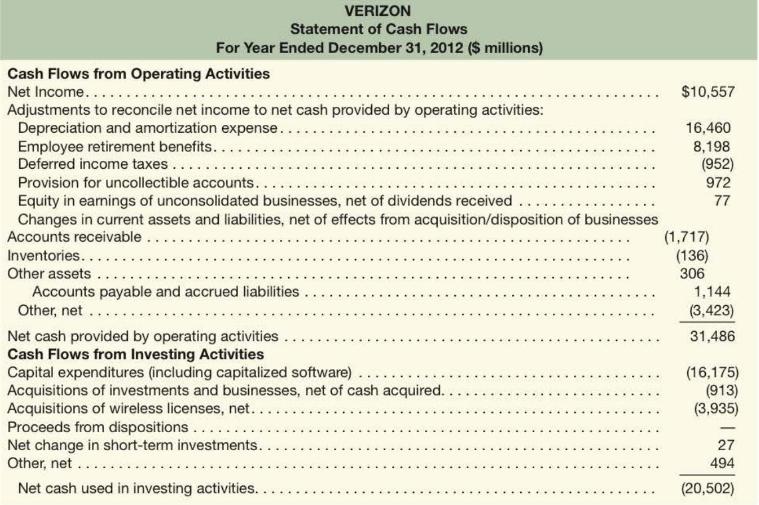

Following is the statement of cash flows for Verizon. Required a. Why does Verizon add back depreciation

Question:

Following is the statement of cash flows for Verizon.

Required

a. Why does Verizon add back depreciation to compute net cash flows from operating activities? What does the size of the depreciation add-back indicate about the relative capital intensity of this industry?

b. Verizon reports that it invested $16,17 million in property and equipment. These expenditures are necessitated by market pressures as the company faces stiff competition from other communications companies, such as Comcast. Where in the 10-K might we find additional information about these capital expenditures to ascertain whether Verizon is addressing the company's most pressing needs? What relation might we expect between the size of these capital expenditures and the amount of depreciation expense reported?

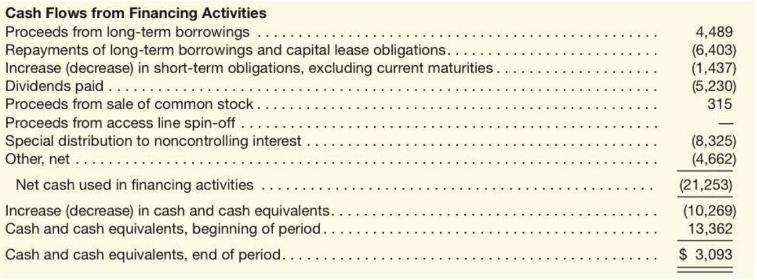

c. Verizon's statement of cash flows indicates that the company paid $6,403 million in debt payments. What problem does Verizon's high debt load pose for its ability to maintain the level of capital expenditures necessary to remain competitive in its industry?

d. During the year, Verizon paid dividends of $ 5,230 million but did not repay a sizeable portion of its debt. How do dividend payments differ from debt payments? Why would Verizon continue to pay dividends in light of cash demands for needed capital expenditures and debt repayments?

e. Provide an overall assessment of Verizon's cash flows for 2012. In the analysis, consider the sources and uses of cash.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton