Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to

Question:

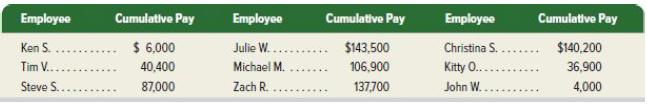

Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee.

Cumulative pay for the current year for each of its employees follows.

a. Prepare a table with the following six column headings. Compute the amounts in this table for each employee and then total the numerical columns.

![]()

b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint:

Remember to include in those totals any employee share of taxes that the company must collect. Round amounts to cents.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: