Using the data in situation (a) of Exercise 9-7, prepare the employers September 30 journal entry

Question:

Using the data in situation (a) of Exercise 9-7, prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities. Round amounts to cents.

Data from Exercise 9-7

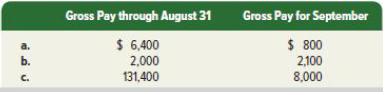

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). Round amounts to cents.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: